- Malaysia

- /

- Medical Equipment

- /

- KLSE:COMFORT

Why We're Not Concerned Yet About Comfort Gloves Berhad's (KLSE:COMFORT) 28% Share Price Plunge

Comfort Gloves Berhad (KLSE:COMFORT) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. Nonetheless, the last 30 days have barely left a scratch on the stock's annual performance, which is up a whopping 334%.

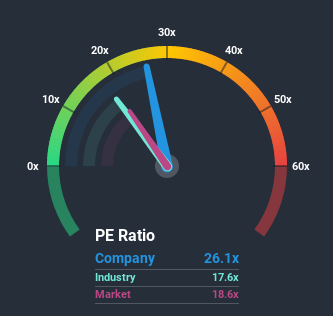

Even after such a large drop in price, Comfort Gloves Berhad's price-to-earnings (or "P/E") ratio of 26.1x might still make it look like a sell right now compared to the market in Malaysia, where around half of the companies have P/E ratios below 18x and even P/E's below 12x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times have been pleasing for Comfort Gloves Berhad as its earnings have risen in spite of the market's earnings going into reverse. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Comfort Gloves Berhad

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Comfort Gloves Berhad's is when the company's growth is on track to outshine the market.

If we review the last year of earnings growth, the company posted a terrific increase of 131%. Pleasingly, EPS has also lifted 106% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 48% per year during the coming three years according to the sole analyst following the company. That's shaping up to be materially higher than the 18% each year growth forecast for the broader market.

With this information, we can see why Comfort Gloves Berhad is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Comfort Gloves Berhad's P/E?

Comfort Gloves Berhad's P/E hasn't come down all the way after its stock plunged. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Comfort Gloves Berhad's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for Comfort Gloves Berhad that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

If you decide to trade Comfort Gloves Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Comfort Gloves Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:COMFORT

Comfort Gloves Berhad

An investment holding company, manufactures and trades in latex gloves in Malaysia, the United States, Asia, Europe, Canada, and internationally.

Adequate balance sheet and slightly overvalued.