- Malaysia

- /

- Basic Materials

- /

- KLSE:CEPCO

Here's Why Shareholders May Want To Be Cautious With Increasing Concrete Engineering Products Berhad's (KLSE:CEPCO) CEO Pay Packet

Key Insights

- Concrete Engineering Products Berhad's Annual General Meeting to take place on 15th of January

- Total pay for CEO Kway Wah Leong includes RM525.0k salary

- The overall pay is 216% above the industry average

- Over the past three years, Concrete Engineering Products Berhad's EPS grew by 104% and over the past three years, the total shareholder return was 36%

CEO Kway Wah Leong has done a decent job of delivering relatively good performance at Concrete Engineering Products Berhad (KLSE:CEPCO) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 15th of January. However, some shareholders may still want to keep CEO compensation within reason.

See our latest analysis for Concrete Engineering Products Berhad

How Does Total Compensation For Kway Wah Leong Compare With Other Companies In The Industry?

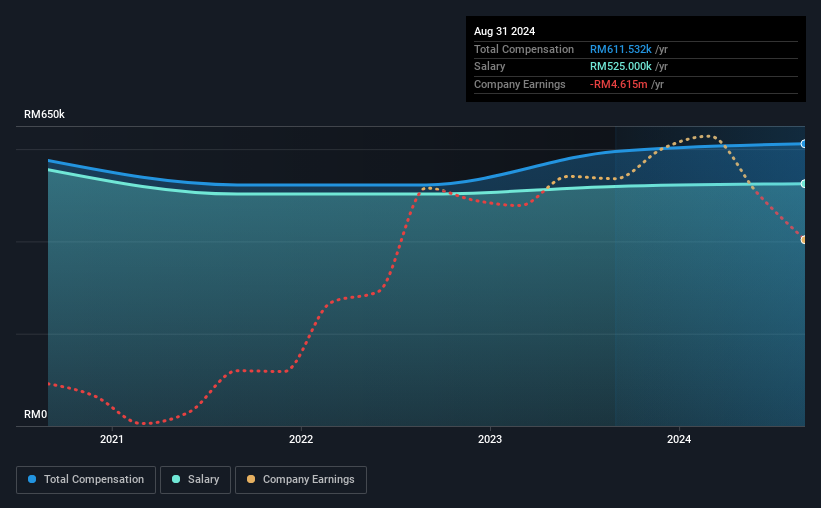

According to our data, Concrete Engineering Products Berhad has a market capitalization of RM88m, and paid its CEO total annual compensation worth RM612k over the year to August 2024. This means that the compensation hasn't changed much from last year. We note that the salary portion, which stands at RM525.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the Malaysia Basic Materials industry with market capitalizations below RM901m, reported a median total CEO compensation of RM194k. Hence, we can conclude that Kway Wah Leong is remunerated higher than the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | RM525k | RM519k | 86% |

| Other | RM87k | RM76k | 14% |

| Total Compensation | RM612k | RM595k | 100% |

Talking in terms of the industry, salary represented approximately 86% of total compensation out of all the companies we analyzed, while other remuneration made up 14% of the pie. Concrete Engineering Products Berhad is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Concrete Engineering Products Berhad's Growth Numbers

Over the past three years, Concrete Engineering Products Berhad has seen its earnings per share (EPS) grow by 104% per year. It saw its revenue drop 22% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Concrete Engineering Products Berhad Been A Good Investment?

Most shareholders would probably be pleased with Concrete Engineering Products Berhad for providing a total return of 36% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Concrete Engineering Products Berhad that you should be aware of before investing.

Switching gears from Concrete Engineering Products Berhad, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CEPCO

Concrete Engineering Products Berhad

Manufactures and distributes prestressed spun concrete piles and poles in Malaysia.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.