Investors Who Bought Asia Poly Holdings Berhad (KLSE:ASIAPLY) Shares A Year Ago Are Now Up 409%

While Asia Poly Holdings Berhad (KLSE:ASIAPLY) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 30% in the last quarter. But that cannot eclipse the spectacular share price rise we've seen over the last twelve months. Few could complain about the impressive 409% rise, throughout the period. So we wouldn't blame sellers for taking some profits. The real question is whether the fundamental business performance can justify the strong increase over the long term.

View our latest analysis for Asia Poly Holdings Berhad

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Asia Poly Holdings Berhad grew its earnings per share, moving from a loss to a profit.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

Revenue was pretty flat year on year, but maybe a closer look at the data can explain the market optimism.

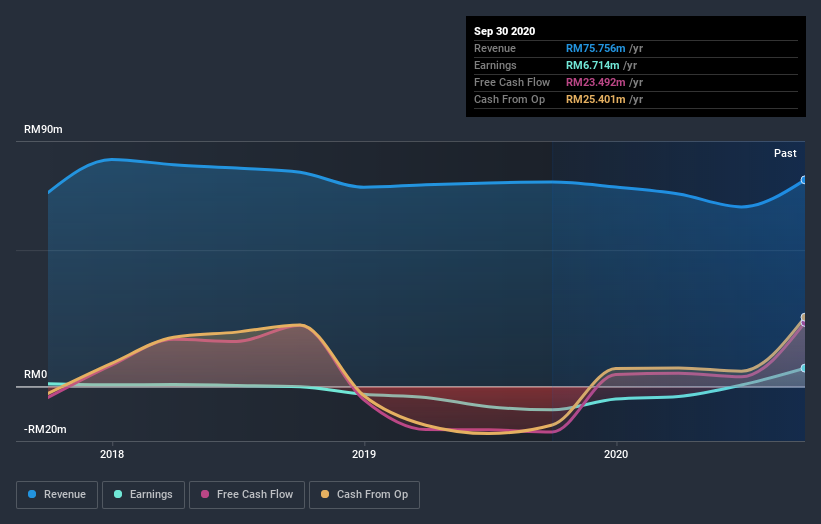

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Asia Poly Holdings Berhad stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Asia Poly Holdings Berhad shareholders have received a total shareholder return of 409% over one year. That's better than the annualised return of 8% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 5 warning signs for Asia Poly Holdings Berhad (2 are concerning) that you should be aware of.

But note: Asia Poly Holdings Berhad may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

When trading Asia Poly Holdings Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Asia Poly Holdings Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:ASIAPLY

Asia Poly Holdings Berhad

An investment holding company, manufactures and sells cell cast acrylic sheets.

Slight with mediocre balance sheet.

Market Insights

Community Narratives