- Malaysia

- /

- Metals and Mining

- /

- KLSE:ANNJOO

Investors Appear Satisfied With Ann Joo Resources Berhad's (KLSE:ANNJOO) Prospects As Shares Rocket 26%

Ann Joo Resources Berhad (KLSE:ANNJOO) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 35% over that time.

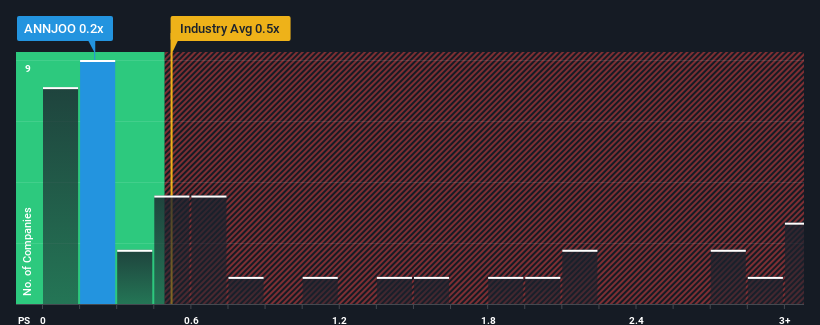

In spite of the firm bounce in price, it's still not a stretch to say that Ann Joo Resources Berhad's price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Metals and Mining industry in Malaysia, where the median P/S ratio is around 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

We've discovered 2 warning signs about Ann Joo Resources Berhad. View them for free.Check out our latest analysis for Ann Joo Resources Berhad

How Ann Joo Resources Berhad Has Been Performing

Recent times haven't been great for Ann Joo Resources Berhad as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Ann Joo Resources Berhad's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Ann Joo Resources Berhad?

The only time you'd be comfortable seeing a P/S like Ann Joo Resources Berhad's is when the company's growth is tracking the industry closely.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period was better as it's delivered a decent 5.4% overall rise in revenue. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 2.1% each year as estimated by the dual analysts watching the company. That's shaping up to be similar to the 3.3% per annum growth forecast for the broader industry.

With this in mind, it makes sense that Ann Joo Resources Berhad's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Ann Joo Resources Berhad's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've seen that Ann Joo Resources Berhad maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

It is also worth noting that we have found 2 warning signs for Ann Joo Resources Berhad (1 makes us a bit uncomfortable!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ANNJOO

Ann Joo Resources Berhad

An investment holding company, manufactures and trades in iron, steel, and steel related products in Malaysia and Singapore.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives