Should You Or Shouldn't You: A Dividend Analysis on MNRB Holdings Berhad (KLSE:MNRB)

Is MNRB Holdings Berhad (KLSE:MNRB) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

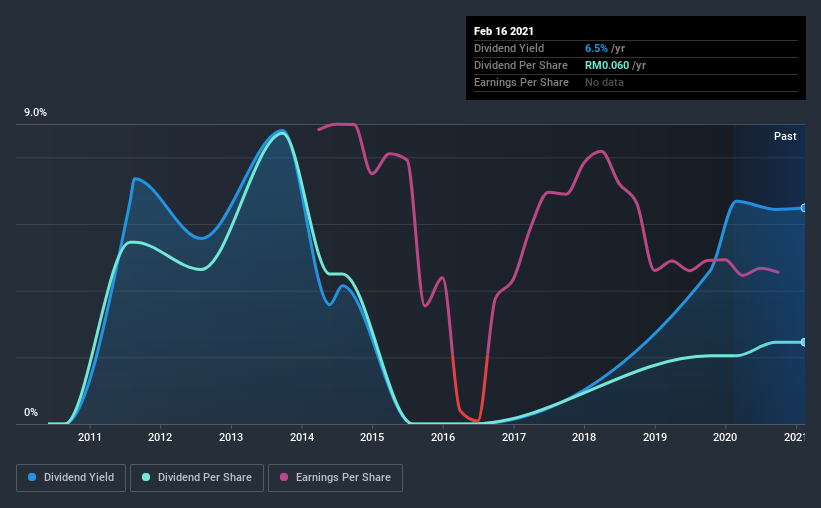

In this case, MNRB Holdings Berhad likely looks attractive to investors, given its 6.5% dividend yield and a payment history of over ten years. We'd guess that plenty of investors have purchased it for the income. Some simple analysis can reduce the risk of holding MNRB Holdings Berhad for its dividend, and we'll focus on the most important aspects below.

Explore this interactive chart for our latest analysis on MNRB Holdings Berhad!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. MNRB Holdings Berhad paid out 2.8% of its profit as dividends, over the trailing twelve month period. Given the low payout ratio, it is hard to envision the dividend coming under threat, barring a catastrophe.

Remember, you can always get a snapshot of MNRB Holdings Berhad's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. For the purpose of this article, we only scrutinise the last decade of MNRB Holdings Berhad's dividend payments. Its dividend payments have declined on at least one occasion over the past 10 years. During the past 10-year period, the first annual payment was RM0.1 in 2011, compared to RM0.06 last year. The dividend has shrunk at around 7.7% a year during that period. MNRB Holdings Berhad's dividend has been cut sharply at least once, so it hasn't fallen by 7.7% every year, but this is a decent approximation of the long term change.

When a company's per-share dividend falls we question if this reflects poorly on either external business conditions, or the company's capital allocation decisions. Either way, we find it hard to get excited about a company with a declining dividend.

Dividend Growth Potential

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS are growing. It's good to see MNRB Holdings Berhad has been growing its earnings per share at 11% a year over the past five years. Rapid earnings growth and a low payout ratio suggests this company has been effectively reinvesting in its business. Should that continue, this company could have a bright future.

We'd also point out that MNRB Holdings Berhad issued a meaningful number of new shares in the past year. Regularly issuing new shares can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Firstly, we like that MNRB Holdings Berhad has a low and conservative payout ratio. Next, earnings growth has been good, but unfortunately the dividend has been cut at least once in the past. MNRB Holdings Berhad has a number of positive attributes, but falls short of our ideal dividend company. It may be worth a look at the right price, though.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've picked out 2 warning signs for MNRB Holdings Berhad that investors should know about before committing capital to this stock.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

When trading MNRB Holdings Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:MNRB

MNRB Holdings Berhad

An investment holding company, engages in the general reinsurance, takaful, and retakaful businesses in Malaysia and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives