- Malaysia

- /

- Medical Equipment

- /

- KLSE:HARTA

Hartalega Holdings Berhad's (KLSE:HARTA) Share Price Not Quite Adding Up

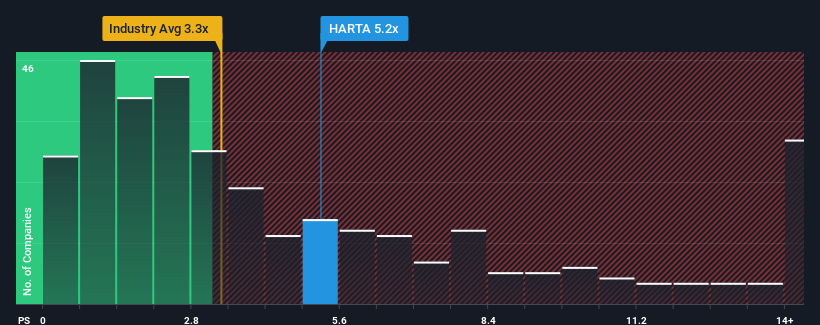

With a price-to-sales (or "P/S") ratio of 5.2x Hartalega Holdings Berhad (KLSE:HARTA) may be sending very bearish signals at the moment, given that almost half of all the Medical Equipment companies in Malaysia have P/S ratios under 3.1x and even P/S lower than 1x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Hartalega Holdings Berhad

How Has Hartalega Holdings Berhad Performed Recently?

Hartalega Holdings Berhad's negative revenue growth of late has neither been better nor worse than most other companies. It might be that many expect the company's revenue to strengthen positively despite the tough industry conditions, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Hartalega Holdings Berhad's future stacks up against the industry? In that case, our free report is a great place to start.How Is Hartalega Holdings Berhad's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Hartalega Holdings Berhad's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 36% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 65% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 3.6% per year as estimated by the analysts watching the company. Meanwhile, the broader industry is forecast to expand by 16% per year, which paints a poor picture.

In light of this, it's alarming that Hartalega Holdings Berhad's P/S sits above the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What Does Hartalega Holdings Berhad's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Hartalega Holdings Berhad's analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Hartalega Holdings Berhad with six simple checks.

If you're unsure about the strength of Hartalega Holdings Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hartalega Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HARTA

Hartalega Holdings Berhad

An investment holding company, engages in the manufacture, retail, and wholesale of latex and nitrile gloves in Malaysia, North America, Europe, Asia, Australia, the Middle East, and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026