Our Take On The Returns On Capital At United Plantations Berhad (KLSE:UTDPLT)

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Although, when we looked at United Plantations Berhad (KLSE:UTDPLT), it didn't seem to tick all of these boxes.

Return On Capital Employed (ROCE): What is it?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for United Plantations Berhad, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.17 = RM479m ÷ (RM3.0b - RM177m) (Based on the trailing twelve months to December 2020).

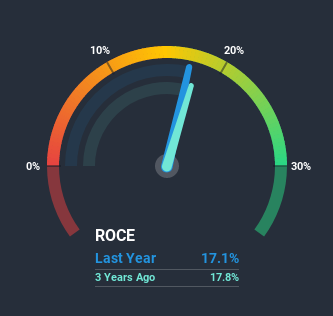

Therefore, United Plantations Berhad has an ROCE of 17%. In absolute terms, that's a satisfactory return, but compared to the Food industry average of 7.6% it's much better.

See our latest analysis for United Plantations Berhad

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how United Plantations Berhad has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

What The Trend Of ROCE Can Tell Us

Things have been pretty stable at United Plantations Berhad, with its capital employed and returns on that capital staying somewhat the same for the last five years. This tells us the company isn't reinvesting in itself, so it's plausible that it's past the growth phase. So unless we see a substantial change at United Plantations Berhad in terms of ROCE and additional investments being made, we wouldn't hold our breath on it being a multi-bagger.

In Conclusion...

In a nutshell, United Plantations Berhad has been trudging along with the same returns from the same amount of capital over the last five years. Unsurprisingly, the stock has only gained 39% over the last five years, which potentially indicates that investors are accounting for this going forward. As a result, if you're hunting for a multi-bagger, we think you'd have more luck elsewhere.

One more thing, we've spotted 1 warning sign facing United Plantations Berhad that you might find interesting.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you decide to trade United Plantations Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:UTDPLT

United Plantations Berhad

Engages in the cultivation and processing of oil palm and coconuts in Malaysia, Indonesia, Europe, the United States, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives