It's A Story Of Risk Vs Reward With United Plantations Berhad (KLSE:UTDPLT)

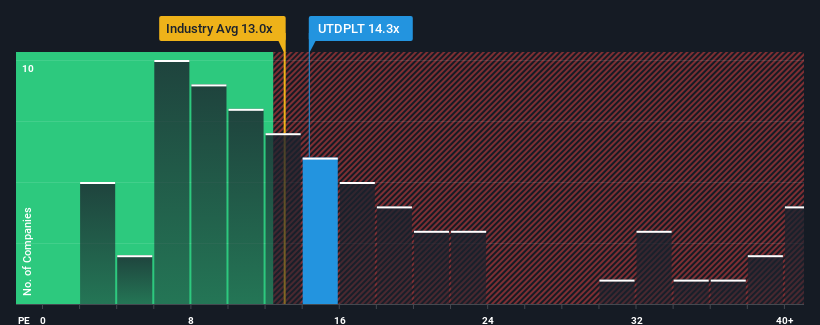

There wouldn't be many who think United Plantations Berhad's (KLSE:UTDPLT) price-to-earnings (or "P/E") ratio of 14.3x is worth a mention when the median P/E in Malaysia is similar at about 16x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

The earnings growth achieved at United Plantations Berhad over the last year would be more than acceptable for most companies. One possibility is that the P/E is moderate because investors think this respectable earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

View our latest analysis for United Plantations Berhad

Is There Some Growth For United Plantations Berhad?

In order to justify its P/E ratio, United Plantations Berhad would need to produce growth that's similar to the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 20% last year. The latest three year period has also seen an excellent 86% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is only predicted to deliver 17% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it interesting that United Plantations Berhad is trading at a fairly similar P/E to the market. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On United Plantations Berhad's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that United Plantations Berhad currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Having said that, be aware United Plantations Berhad is showing 2 warning signs in our investment analysis, and 1 of those is a bit concerning.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:UTDPLT

United Plantations Berhad

Engages in the cultivation and processing of oil palm and coconuts in Malaysia, Indonesia, Europe, the United States, and internationally.

Flawless balance sheet with proven track record and pays a dividend.