We Like SDS Group Berhad's (KLSE:SDS) Earnings For More Than Just Statutory Profit

SDS Group Berhad's (KLSE:SDS) recent earnings report didn't offer any surprises, with the shares unchanged over the last week. We did some digging, and we think that investors are missing some encouraging factors in the underlying numbers.

See our latest analysis for SDS Group Berhad

Zooming In On SDS Group Berhad's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

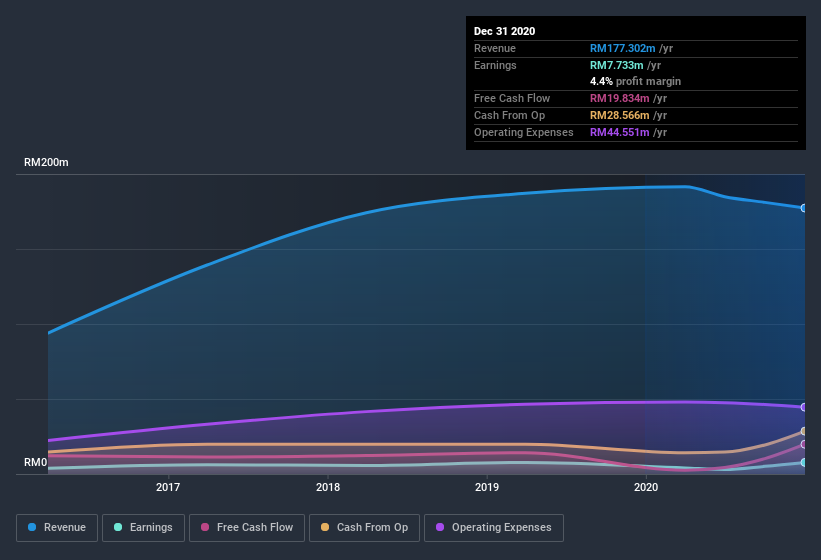

SDS Group Berhad has an accrual ratio of -0.15 for the year to December 2020. That indicates that its free cash flow quite significantly exceeded its statutory profit. Indeed, in the last twelve months it reported free cash flow of RM20m, well over the RM7.73m it reported in profit. SDS Group Berhad's free cash flow improved over the last year, which is generally good to see.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of SDS Group Berhad.

Our Take On SDS Group Berhad's Profit Performance

As we discussed above, SDS Group Berhad has perfectly satisfactory free cash flow relative to profit. Because of this, we think SDS Group Berhad's earnings potential is at least as good as it seems, and maybe even better! And on top of that, its earnings per share increased by 27% in the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. You'd be interested to know, that we found 1 warning sign for SDS Group Berhad and you'll want to know about it.

This note has only looked at a single factor that sheds light on the nature of SDS Group Berhad's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade SDS Group Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:SDS

SDS Group Berhad

An investment holding company, engages in the manufacture, distribution, and retail of bakery products in Malaysia, Singapore, and Indonesia.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026