If EPS Growth Is Important To You, QL Resources Berhad (KLSE:QL) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like QL Resources Berhad (KLSE:QL). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for QL Resources Berhad

How Quickly Is QL Resources Berhad Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Over the last three years, QL Resources Berhad has grown EPS by 13% per year. That's a pretty good rate, if the company can sustain it.

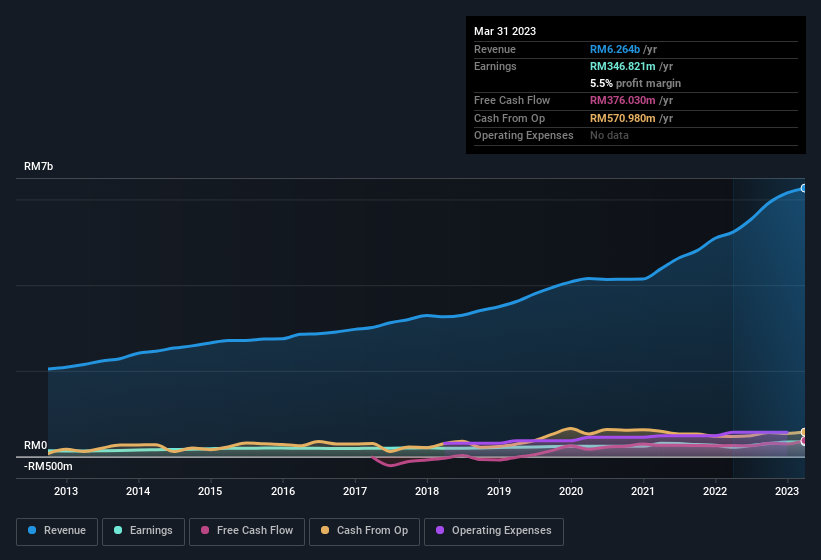

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note QL Resources Berhad achieved similar EBIT margins to last year, revenue grew by a solid 20% to RM6.3b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of QL Resources Berhad's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are QL Resources Berhad Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. QL Resources Berhad followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. With a whopping RM441m worth of shares as a group, insiders have plenty riding on the company's success. That's certainly enough to let shareholders know that management will be very focussed on long term growth.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. Our analysis has discovered that the median total compensation for the CEOs of companies like QL Resources Berhad with market caps between RM9.1b and RM29b is about RM4.7m.

The QL Resources Berhad CEO received total compensation of only RM108k in the year to March 2022. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does QL Resources Berhad Deserve A Spot On Your Watchlist?

One important encouraging feature of QL Resources Berhad is that it is growing profits. The growth of EPS may be the eye-catching headline for QL Resources Berhad, but there's more to bring joy for shareholders. With company insiders aligning themselves considerably with the company's success and modest CEO compensation, there's no arguments that this is a stock worth looking into. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if QL Resources Berhad is trading on a high P/E or a low P/E, relative to its industry.

Although QL Resources Berhad certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if QL Resources Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:QL

QL Resources Berhad

An investment holding, operates as an agro-food company in Malaysia, Indonesia, Vietnam, and internationally.

Flawless balance sheet with limited growth.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026