Solid Earnings May Not Tell The Whole Story For Keck Seng (Malaysia) Berhad (KLSE:KSENG)

Keck Seng (Malaysia) Berhad's (KLSE:KSENG) robust recent earnings didn't do much to move the stock. We think this is due to investors looking beyond the statutory profits and being concerned with what they see.

See our latest analysis for Keck Seng (Malaysia) Berhad

The Impact Of Unusual Items On Profit

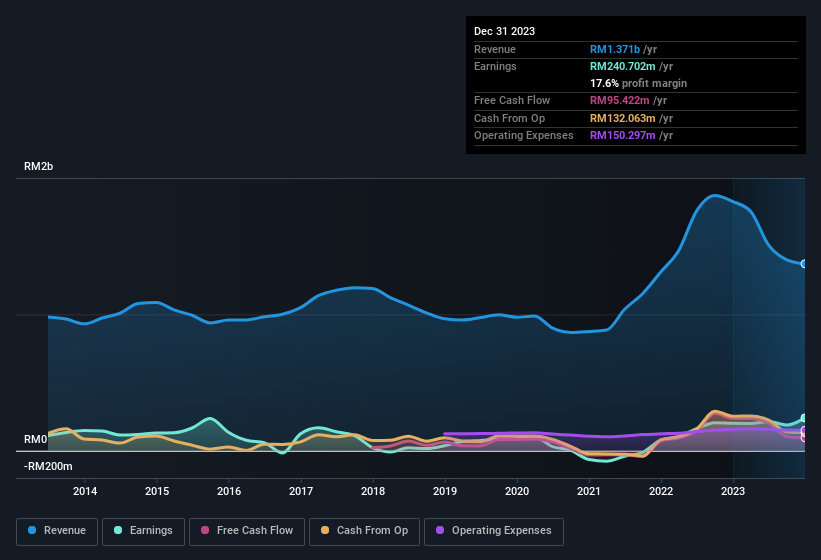

Importantly, our data indicates that Keck Seng (Malaysia) Berhad's profit received a boost of RM125m in unusual items, over the last year. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. Which is hardly surprising, given the name. We can see that Keck Seng (Malaysia) Berhad's positive unusual items were quite significant relative to its profit in the year to December 2023. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Keck Seng (Malaysia) Berhad.

Our Take On Keck Seng (Malaysia) Berhad's Profit Performance

As previously mentioned, Keck Seng (Malaysia) Berhad's large boost from unusual items won't be there indefinitely, so its statutory earnings are probably a poor guide to its underlying profitability. As a result, we think it may well be the case that Keck Seng (Malaysia) Berhad's underlying earnings power is lower than its statutory profit. But at least holders can take some solace from the 19% EPS growth in the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So while earnings quality is important, it's equally important to consider the risks facing Keck Seng (Malaysia) Berhad at this point in time. Every company has risks, and we've spotted 2 warning signs for Keck Seng (Malaysia) Berhad you should know about.

Today we've zoomed in on a single data point to better understand the nature of Keck Seng (Malaysia) Berhad's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Keck Seng (Malaysia) Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KSENG

Keck Seng (Malaysia) Berhad

Engages in the cultivation and sale of oil palm in Malaysia, Singapore, Hong Kong, Canada, and the United States.

Flawless balance sheet with questionable track record.