Here's Why We Think Greenyield Berhad (KLSE:GREENYB) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Greenyield Berhad (KLSE:GREENYB). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Greenyield Berhad

How Fast Is Greenyield Berhad Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. To the delight of shareholders, Greenyield Berhad has achieved impressive annual EPS growth of 54%, compound, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

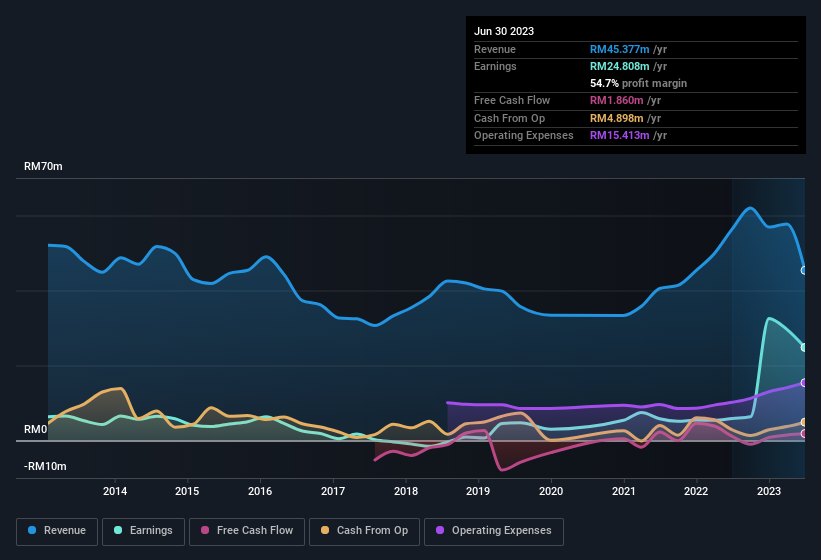

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The previous 12 months are something that Greenyield Berhad will want to put behind them after seeing a drop in EBIT margin and revenue for the period. That will not make it easy to grow profits, to say the least.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Greenyield Berhad is no giant, with a market capitalisation of RM114m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Greenyield Berhad Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So we're pleased to report that Greenyield Berhad insiders own a meaningful share of the business. Actually, with 38% of the company to their names, insiders are profoundly invested in the business. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Valued at only RM114m Greenyield Berhad is really small for a listed company. So despite a large proportional holding, insiders only have RM44m worth of stock. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

Does Greenyield Berhad Deserve A Spot On Your Watchlist?

Greenyield Berhad's earnings have taken off in quite an impressive fashion. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So based on this quick analysis, we do think it's worth considering Greenyield Berhad for a spot on your watchlist. We don't want to rain on the parade too much, but we did also find 3 warning signs for Greenyield Berhad (1 is significant!) that you need to be mindful of.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:GREENYB

Greenyield Berhad

An investment holding company, develops, manufactures, markets, and distributes agricultural and horticultural solutions.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026