Does Can-One Berhad (KLSE:CANONE) Have A Healthy Balance Sheet?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Can-One Berhad (KLSE:CANONE) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Can-One Berhad

What Is Can-One Berhad's Net Debt?

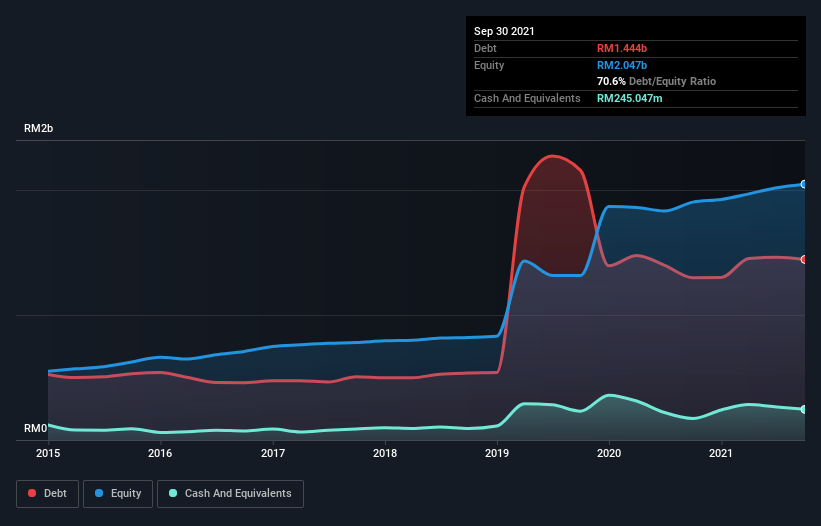

The image below, which you can click on for greater detail, shows that at September 2021 Can-One Berhad had debt of RM1.44b, up from RM1.30b in one year. However, it does have RM245.0m in cash offsetting this, leading to net debt of about RM1.20b.

A Look At Can-One Berhad's Liabilities

According to the last reported balance sheet, Can-One Berhad had liabilities of RM1.20b due within 12 months, and liabilities of RM865.8m due beyond 12 months. Offsetting this, it had RM245.0m in cash and RM630.2m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM1.19b.

This deficit casts a shadow over the RM726.3m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Can-One Berhad would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Can-One Berhad has a debt to EBITDA ratio of 3.5 and its EBIT covered its interest expense 5.7 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Notably, Can-One Berhad made a loss at the EBIT level, last year, but improved that to positive EBIT of RM225m in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Can-One Berhad will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Over the last year, Can-One Berhad saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both Can-One Berhad's conversion of EBIT to free cash flow and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. Having said that, its ability to cover its interest expense with its EBIT isn't such a worry. After considering the datapoints discussed, we think Can-One Berhad has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Can-One Berhad (2 are potentially serious) you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CANONE

Can-One Berhad

An investment holding company, manufactures and sells metal and lithographed tin cans, plastic jerry cans, rigid packaging products, aluminum cans, and corrugated fiberboard cartons in Malaysia, Vietnam, Singapore, Myanmar, Indonesia, and the United States of America.

Good value with acceptable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026