Can-One Berhad (KLSE:CANONE) Use Of Debt Could Be Considered Risky

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Can-One Berhad (KLSE:CANONE) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Can-One Berhad

How Much Debt Does Can-One Berhad Carry?

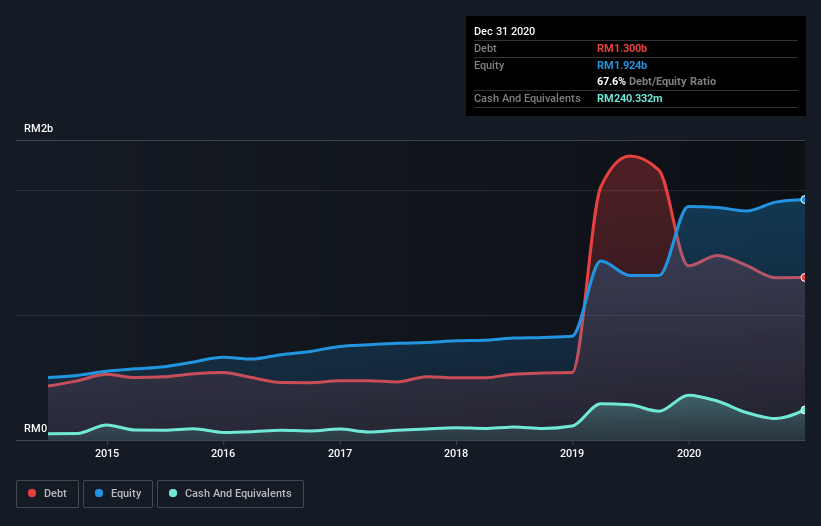

You can click the graphic below for the historical numbers, but it shows that Can-One Berhad had RM1.30b of debt in December 2020, down from RM1.39b, one year before. However, because it has a cash reserve of RM240.3m, its net debt is less, at about RM1.06b.

How Healthy Is Can-One Berhad's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Can-One Berhad had liabilities of RM974.6m due within 12 months and liabilities of RM889.7m due beyond that. Offsetting these obligations, it had cash of RM240.3m as well as receivables valued at RM585.4m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM1.04b.

This deficit casts a shadow over the RM528.4m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Can-One Berhad would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Weak interest cover of 1.4 times and a disturbingly high net debt to EBITDA ratio of 5.7 hit our confidence in Can-One Berhad like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. Even worse, Can-One Berhad saw its EBIT tank 78% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. When analysing debt levels, the balance sheet is the obvious place to start. But it is Can-One Berhad's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. In the last three years, Can-One Berhad created free cash flow amounting to 13% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

To be frank both Can-One Berhad's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. And even its net debt to EBITDA fails to inspire much confidence. Considering all the factors previously mentioned, we think that Can-One Berhad really is carrying too much debt. To us, that makes the stock rather risky, like walking through a dog park with your eyes closed. But some investors may feel differently. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 4 warning signs for Can-One Berhad you should be aware of, and 2 of them make us uncomfortable.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:CANONE

Can-One Berhad

An investment holding company, manufactures and sells metal and lithographed tin cans, plastic jerry cans, rigid packaging products, aluminum cans, and corrugated fiberboard cartons in Malaysia, Vietnam, Singapore, Myanmar, Indonesia, and the United States of America.

Good value with acceptable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026