- Malaysia

- /

- Energy Services

- /

- KLSE:DAYANG

Market Participants Recognise Dayang Enterprise Holdings Bhd's (KLSE:DAYANG) Revenues Pushing Shares 28% Higher

Dayang Enterprise Holdings Bhd (KLSE:DAYANG) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 39% in the last year.

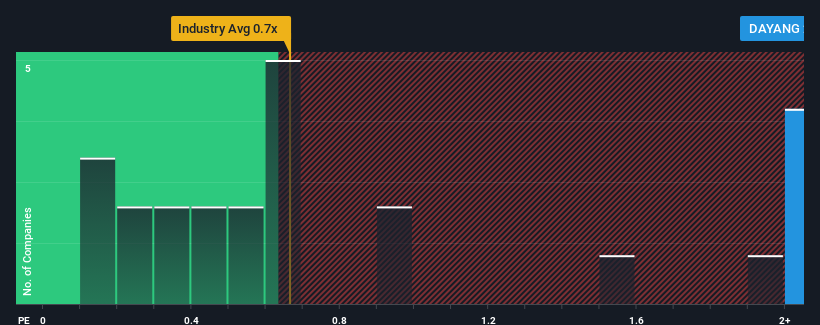

After such a large jump in price, you could be forgiven for thinking Dayang Enterprise Holdings Bhd is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.4x, considering almost half the companies in Malaysia's Energy Services industry have P/S ratios below 0.7x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Dayang Enterprise Holdings Bhd

How Has Dayang Enterprise Holdings Bhd Performed Recently?

Dayang Enterprise Holdings Bhd could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Dayang Enterprise Holdings Bhd will help you uncover what's on the horizon.How Is Dayang Enterprise Holdings Bhd's Revenue Growth Trending?

Dayang Enterprise Holdings Bhd's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period was better as it's delivered a decent 15% overall rise in revenue. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 14% as estimated by the five analysts watching the company. With the rest of the industry predicted to shrink by 6.1%, that would be a fantastic result.

With this information, we can see why Dayang Enterprise Holdings Bhd is trading at such a high P/S compared to the industry. At this time, shareholders aren't keen to offload something that is potentially eyeing a much more prosperous future.

The Key Takeaway

The large bounce in Dayang Enterprise Holdings Bhd's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we anticipated, our review of Dayang Enterprise Holdings Bhd's analyst forecasts shows that the company's better revenue forecast compared to a turbulent industry is a significant contributor to its high price-to-sales ratio. Outperforming the industry in this manner looks to have provided investors with a bit of confidence that the future will be bright, bolstering the P/S. Questions could still raised over whether this level of outperformance can continue in the context of a a tumultuous industry climate. Otherwise, it's hard to see the share price falling strongly in the near future under the current growth expectations.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Dayang Enterprise Holdings Bhd with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Dayang Enterprise Holdings Bhd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:DAYANG

Dayang Enterprise Holdings Bhd

An investment holding company, provides offshore topside maintenance services, minor fabrication works, and offshore hook-up and commissioning services to the oil and gas companies in Malaysia.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives