- Malaysia

- /

- Consumer Finance

- /

- KLSE:RCECAP

Here's Why We Think RCE Capital Berhad (KLSE:RCECAP) Is Well Worth Watching

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in RCE Capital Berhad (KLSE:RCECAP). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for RCE Capital Berhad

How Quickly Is RCE Capital Berhad Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, RCE Capital Berhad has grown EPS by 9.4% per year. That's a pretty good rate, if the company can sustain it.

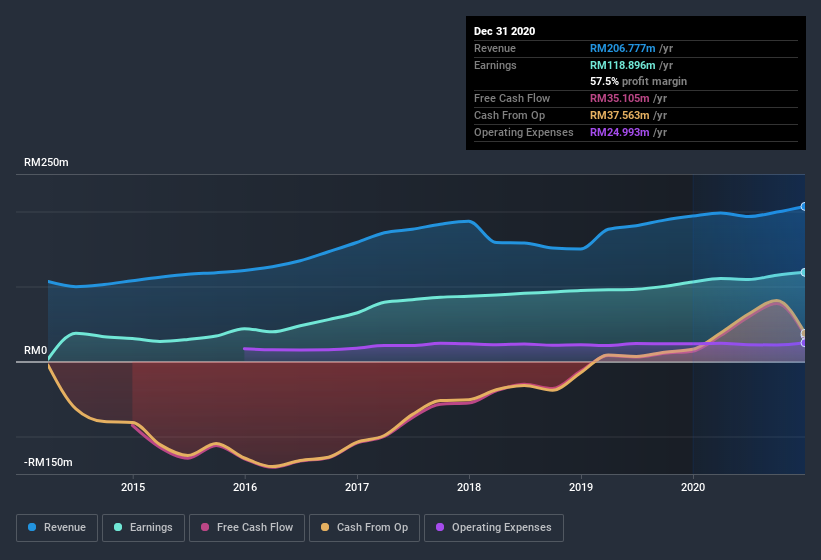

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that RCE Capital Berhad's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. RCE Capital Berhad maintained stable EBIT margins over the last year, all while growing revenue 6.6% to RM207m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for RCE Capital Berhad?

Are RCE Capital Berhad Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that RCE Capital Berhad insiders have a significant amount of capital invested in the stock. To be specific, they have RM107m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 11% of the company, demonstrating a degree of high-level alignment with shareholders.

Does RCE Capital Berhad Deserve A Spot On Your Watchlist?

One positive for RCE Capital Berhad is that it is growing EPS. That's nice to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for RCE Capital Berhad (1 shouldn't be ignored) you should be aware of.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade RCE Capital Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:RCECAP

RCE Capital Berhad

An investment holding company, provides financial services in Malaysia.

Average dividend payer with moderate growth potential.

Market Insights

Community Narratives