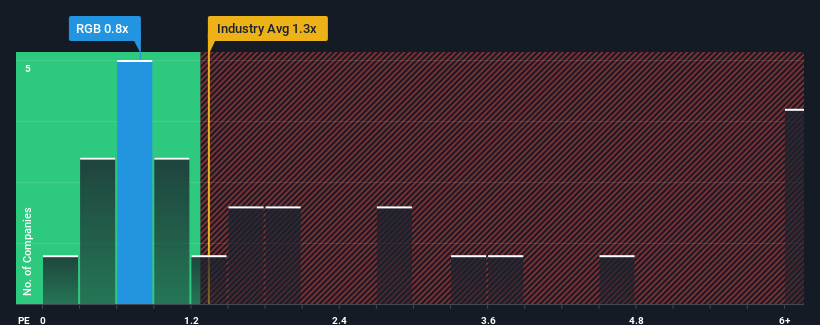

You may think that with a price-to-sales (or "P/S") ratio of 0.8x RGB International Bhd. (KLSE:RGB) is a stock worth checking out, seeing as almost half of all the Hospitality companies in Malaysia have P/S ratios greater than 1.3x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for RGB International Bhd

How RGB International Bhd Has Been Performing

With revenue growth that's superior to most other companies of late, RGB International Bhd has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think RGB International Bhd's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For RGB International Bhd?

In order to justify its P/S ratio, RGB International Bhd would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 160% gain to the company's top line. The latest three year period has also seen an excellent 270% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 17% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 4.5%, which is noticeably less attractive.

With this information, we find it odd that RGB International Bhd is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On RGB International Bhd's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

RGB International Bhd's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Having said that, be aware RGB International Bhd is showing 1 warning sign in our investment analysis, you should know about.

If you're unsure about the strength of RGB International Bhd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:RGB

RGB International Bhd

An investment holding company, engages in the manufacturing, marketing, trading, and sale of electronic gaming machines (EGM) and equipment under the RGBGames brand.

Flawless balance sheet with solid track record and pays a dividend.