- Malaysia

- /

- Hospitality

- /

- KLSE:ICONIC

Potential Upside For Iconic Worldwide Berhad (KLSE:ICONIC) Not Without Risk

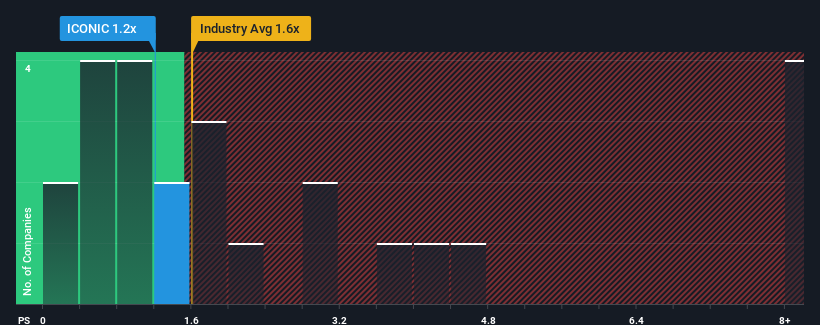

There wouldn't be many who think Iconic Worldwide Berhad's (KLSE:ICONIC) price-to-sales (or "P/S") ratio of 1.2x is worth a mention when the median P/S for the Hospitality industry in Malaysia is similar at about 1.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Iconic Worldwide Berhad

What Does Iconic Worldwide Berhad's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Iconic Worldwide Berhad over the last year, which is not ideal at all. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Iconic Worldwide Berhad's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Iconic Worldwide Berhad?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Iconic Worldwide Berhad's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 58%. Even so, admirably revenue has lifted 44% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

When compared to the industry's one-year growth forecast of 4.7%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that Iconic Worldwide Berhad is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Iconic Worldwide Berhad's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To our surprise, Iconic Worldwide Berhad revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Before you take the next step, you should know about the 3 warning signs for Iconic Worldwide Berhad (1 can't be ignored!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ICONIC

Iconic Worldwide Berhad

An investment holding company, engages in tourism and property businesses in Malaysia, Turkey, Australia, Hong Kong, Thailand, Philippines, and the Middle East.

Slight with imperfect balance sheet.

Market Insights

Community Narratives