Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Borneo Oil Berhad (KLSE:BORNOIL) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Borneo Oil Berhad

What Is Borneo Oil Berhad's Debt?

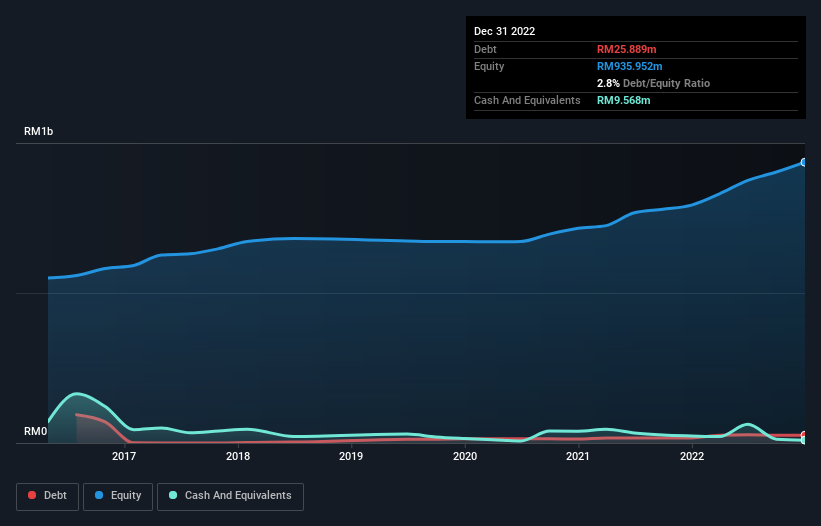

As you can see below, at the end of December 2022, Borneo Oil Berhad had RM25.9m of debt, up from RM16.9m a year ago. Click the image for more detail. On the flip side, it has RM9.57m in cash leading to net debt of about RM16.3m.

How Strong Is Borneo Oil Berhad's Balance Sheet?

We can see from the most recent balance sheet that Borneo Oil Berhad had liabilities of RM20.2m falling due within a year, and liabilities of RM46.1m due beyond that. On the other hand, it had cash of RM9.57m and RM57.3m worth of receivables due within a year. So these liquid assets roughly match the total liabilities.

This state of affairs indicates that Borneo Oil Berhad's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the RM194.2m company is struggling for cash, we still think it's worth monitoring its balance sheet.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Borneo Oil Berhad's net debt is only 0.21 times its EBITDA. And its EBIT easily covers its interest expense, being 50.7 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. In addition to that, we're happy to report that Borneo Oil Berhad has boosted its EBIT by 58%, thus reducing the spectre of future debt repayments. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Borneo Oil Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Borneo Oil Berhad recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

Happily, Borneo Oil Berhad's impressive interest cover implies it has the upper hand on its debt. But the stark truth is that we are concerned by its conversion of EBIT to free cash flow. When we consider the range of factors above, it looks like Borneo Oil Berhad is pretty sensible with its use of debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for Borneo Oil Berhad you should be aware of, and 1 of them can't be ignored.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you're looking to trade Borneo Oil Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Borneo Oil Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:BORNOIL

Borneo Oil Berhad

An investment holding company, operates and franchises fast food restaurants in Malaysia and Australia.

Slight with imperfect balance sheet.

Market Insights

Community Narratives