- Malaysia

- /

- Hospitality

- /

- KLSE:BJFOOD

The Market Doesn't Like What It Sees From Berjaya Food Berhad's (KLSE:BJFOOD) Revenues Yet As Shares Tumble 26%

The Berjaya Food Berhad (KLSE:BJFOOD) share price has fared very poorly over the last month, falling by a substantial 26%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 40% share price drop.

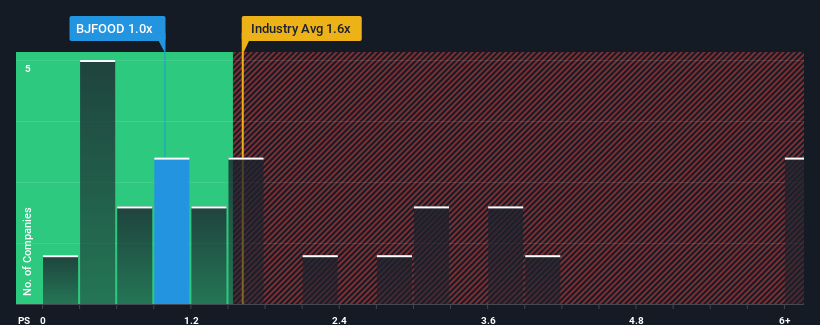

Following the heavy fall in price, Berjaya Food Berhad may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1x, since almost half of all companies in the Hospitality industry in Malaysia have P/S ratios greater than 1.6x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Berjaya Food Berhad

How Berjaya Food Berhad Has Been Performing

Berjaya Food Berhad hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Berjaya Food Berhad.Is There Any Revenue Growth Forecasted For Berjaya Food Berhad?

The only time you'd be truly comfortable seeing a P/S as low as Berjaya Food Berhad's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 35%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 3.2% per year as estimated by the four analysts watching the company. That's shaping up to be materially lower than the 16% each year growth forecast for the broader industry.

In light of this, it's understandable that Berjaya Food Berhad's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Berjaya Food Berhad's P/S Mean For Investors?

Berjaya Food Berhad's recently weak share price has pulled its P/S back below other Hospitality companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Berjaya Food Berhad maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Berjaya Food Berhad that you should be aware of.

If you're unsure about the strength of Berjaya Food Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Berjaya Food Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:BJFOOD

Berjaya Food Berhad

An investment holding company, develops and operates restaurants, café chains, and retail outlets in Malaysia and other Southeast Asian countries.

Good value with concerning outlook.

Market Insights

Community Narratives