- Malaysia

- /

- Food and Staples Retail

- /

- KLSE:KTC

Does Kim Teck Cheong Consolidated Berhad (KLSE:KTC) Have A Healthy Balance Sheet?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Kim Teck Cheong Consolidated Berhad (KLSE:KTC) makes use of debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Kim Teck Cheong Consolidated Berhad

What Is Kim Teck Cheong Consolidated Berhad's Debt?

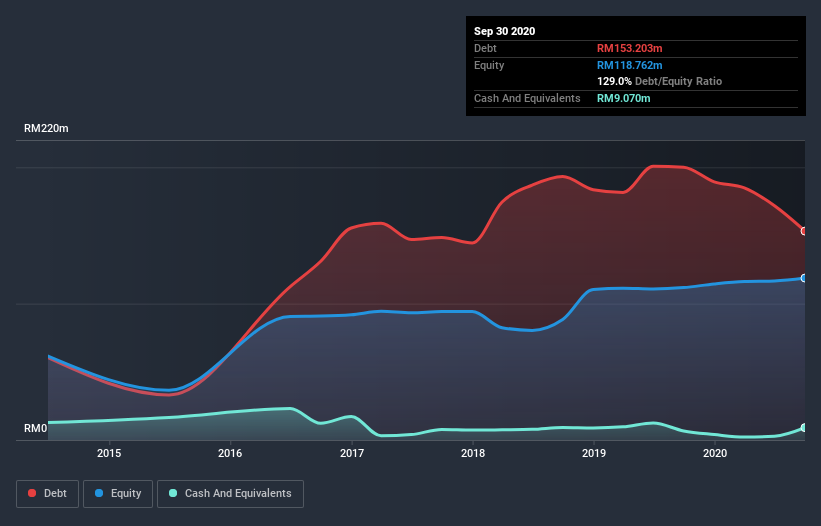

The image below, which you can click on for greater detail, shows that Kim Teck Cheong Consolidated Berhad had debt of RM153.2m at the end of September 2020, a reduction from RM200.0m over a year. However, it also had RM9.07m in cash, and so its net debt is RM144.1m.

How Strong Is Kim Teck Cheong Consolidated Berhad's Balance Sheet?

According to the last reported balance sheet, Kim Teck Cheong Consolidated Berhad had liabilities of RM177.8m due within 12 months, and liabilities of RM32.0m due beyond 12 months. Offsetting this, it had RM9.07m in cash and RM130.0m in receivables that were due within 12 months. So its liabilities total RM70.7m more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of RM100.5m. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Kim Teck Cheong Consolidated Berhad shareholders face the double whammy of a high net debt to EBITDA ratio (6.6), and fairly weak interest coverage, since EBIT is just 2.1 times the interest expense. This means we'd consider it to have a heavy debt load. Investors should also be troubled by the fact that Kim Teck Cheong Consolidated Berhad saw its EBIT drop by 13% over the last twelve months. If things keep going like that, handling the debt will about as easy as bundling an angry house cat into its travel box. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Kim Teck Cheong Consolidated Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Kim Teck Cheong Consolidated Berhad reported free cash flow worth 9.4% of its EBIT, which is really quite low. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

On the face of it, Kim Teck Cheong Consolidated Berhad's interest cover left us tentative about the stock, and its net debt to EBITDA was no more enticing than the one empty restaurant on the busiest night of the year. And even its conversion of EBIT to free cash flow fails to inspire much confidence. We're quite clear that we consider Kim Teck Cheong Consolidated Berhad to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example Kim Teck Cheong Consolidated Berhad has 4 warning signs (and 1 which is a bit unpleasant) we think you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading Kim Teck Cheong Consolidated Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kim Teck Cheong Consolidated Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:KTC

Kim Teck Cheong Consolidated Berhad

Engages in distribution and warehousing of consumer packaged goods in East Malaysia and Brunei.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

De-Risked Production Ramp with Exceptional Silver Price Leverage

The "Google Maps" of Cancer Biology – Data is the Moat

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026