- Malaysia

- /

- Consumer Durables

- /

- KLSE:NIHSIN

Ni Hsin Resources Berhad's (KLSE:NIHSIN) Profits Appear To Have Quality Issues

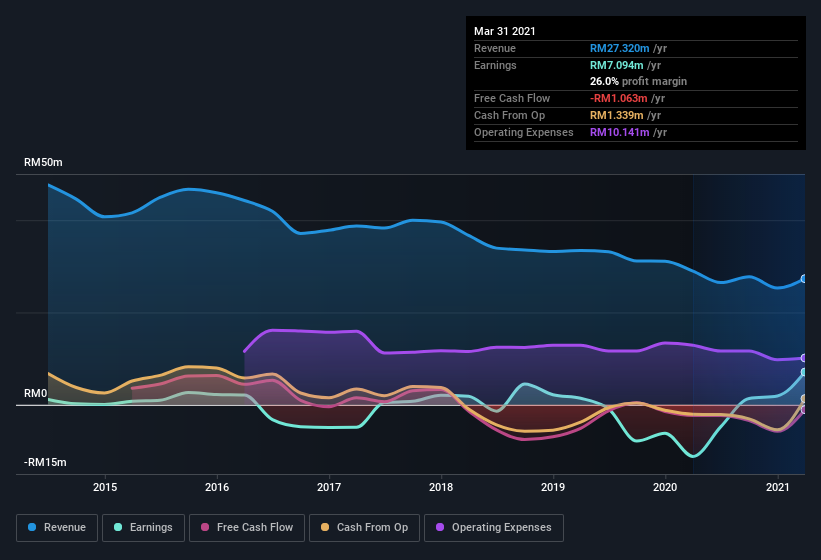

Ni Hsin Resources Berhad's (KLSE:NIHSIN) healthy profit numbers didn't contain any surprises for investors. We think this is due to investors looking beyond the statutory profits and being concerned with what they see.

Check out our latest analysis for Ni Hsin Resources Berhad

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. Ni Hsin Resources Berhad expanded the number of shares on issue by 38% over the last year. That means its earnings are split among a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out Ni Hsin Resources Berhad's historical EPS growth by clicking on this link.

A Look At The Impact Of Ni Hsin Resources Berhad's Dilution on Its Earnings Per Share (EPS).

Unfortunately, we don't have any visibility into its profits three years back, because we lack the data. And even focusing only on the last twelve months, we don't have a meaningful growth rate because it made a loss a year ago, too. But mathematics aside, it is always good to see when a formerly unprofitable business come good (though we accept profit would have been higher if dilution had not been required). So you can see that the dilution has had a fairly significant impact on shareholders.

In the long term, if Ni Hsin Resources Berhad's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Ni Hsin Resources Berhad.

Our Take On Ni Hsin Resources Berhad's Profit Performance

Over the last year Ni Hsin Resources Berhad issued new shares and so, there's a noteworthy divergence between EPS and net income growth. As a result, we think it may well be the case that Ni Hsin Resources Berhad's underlying earnings power is lower than its statutory profit. On the bright side, the company showed enough improvement to book a profit this year, after losing money last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you want to do dive deeper into Ni Hsin Resources Berhad, you'd also look into what risks it is currently facing. You'd be interested to know, that we found 3 warning signs for Ni Hsin Resources Berhad and you'll want to know about these.

Today we've zoomed in on a single data point to better understand the nature of Ni Hsin Resources Berhad's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Ni Hsin Group Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:NIHSIN

Ni Hsin Group Berhad

An investment holding company, designs, manufactures, and sells stainless steel kitchenware and cookware products in Malaysia, Japan, the United States, Europe, Canada, and the Asia Pacific.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026