Is Now The Time To Put KPower Berhad (KLSE:KPOWER) On Your Watchlist?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like KPower Berhad (KLSE:KPOWER), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for KPower Berhad

How Fast Is KPower Berhad Growing Its Earnings Per Share?

Over the last three years, KPower Berhad has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like a falcon taking flight, KPower Berhad's EPS soared from RM0.041 to RM0.06, over the last year. That's a impressive gain of 46%.

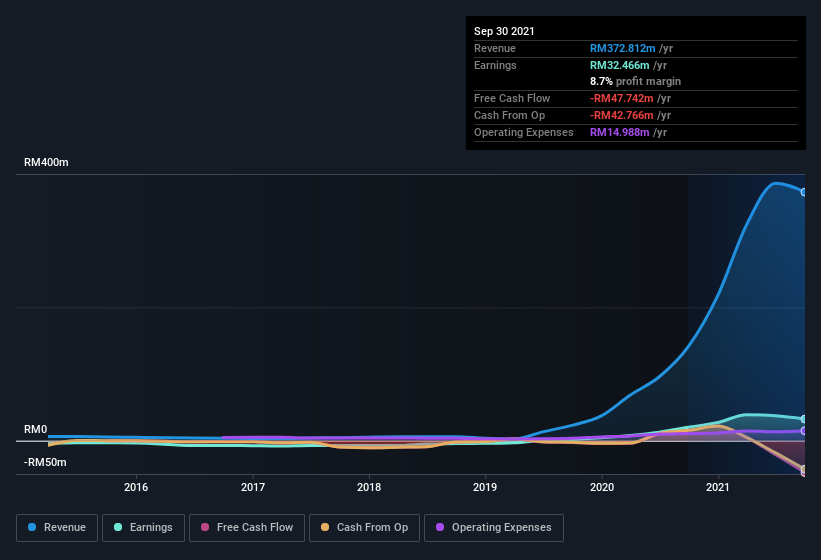

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the one hand, KPower Berhad's EBIT margins fell over the last year, but on the other hand, revenue grew. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

KPower Berhad isn't a huge company, given its market capitalization of RM293m. That makes it extra important to check on its balance sheet strength.

Are KPower Berhad Insiders Aligned With All Shareholders?

I always like to check up on CEO compensation, because I think that reasonable pay levels, around or below the median, can be a sign that shareholder interests are well considered. I discovered that the median total compensation for the CEOs of companies like KPower Berhad with market caps under RM837m is about RM511k.

The KPower Berhad CEO received total compensation of only RM133k in the year to . You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Is KPower Berhad Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about KPower Berhad's strong EPS growth. With swiftly growing earnings, it probably has its best days ahead, and the modest CEO pay suggests the company is careful with cash. So I'd argue this is the kind of stock worth watching, even if it isn't great value today. Still, you should learn about the 5 warning signs we've spotted with KPower Berhad (including 1 which is concerning) .

Although KPower Berhad certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:RENEUCO

Reneuco Berhad

An investment holding company, engages in the logistics, construction related activities, property, investment, and healthcare businesses in Malaysia and internationally.

Slight risk and slightly overvalued.

Market Insights

Community Narratives