- Malaysia

- /

- Consumer Durables

- /

- KLSE:JAYCORP

Jaycorp Berhad (KLSE:JAYCORP) Is Paying Out A Dividend Of MYR0.02

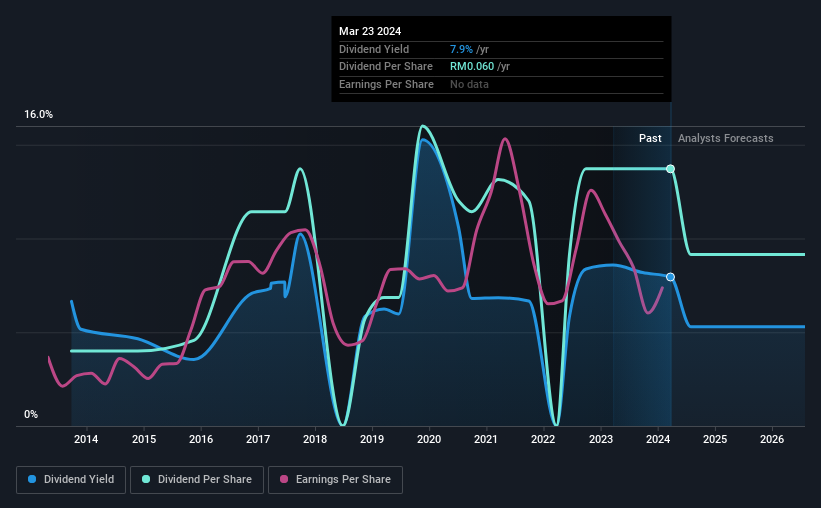

Jaycorp Berhad (KLSE:JAYCORP) will pay a dividend of MYR0.02 on the 29th of April. This means the annual payment is 7.9% of the current stock price, which is above the average for the industry.

See our latest analysis for Jaycorp Berhad

Jaycorp Berhad Is Paying Out More Than It Is Earning

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Based on the last payment, Jaycorp Berhad's earnings were much higher than the dividend, but it wasn't converting those earnings into cash flow. Since a dividend means the company is paying out cash to investors, this could prove to be a problem in the future.

Over the next year, EPS is forecast to expand by 5.4%. If the dividend continues on its recent course, the payout ratio in 12 months could be 97%, which is a bit high and could start applying pressure to the balance sheet.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. The annual payment during the last 10 years was MYR0.0175 in 2014, and the most recent fiscal year payment was MYR0.06. This implies that the company grew its distributions at a yearly rate of about 13% over that duration. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

The Dividend's Growth Prospects Are Limited

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Earnings per share has been crawling upwards at 2.4% per year. Jaycorp Berhad is struggling to find viable investments, so it is returning more to shareholders. This could mean the dividend doesn't have the growth potential we look for going into the future.

Our Thoughts On Jaycorp Berhad's Dividend

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 3 warning signs for Jaycorp Berhad that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:JAYCORP

Jaycorp Berhad

An investment holding company, manufactures and sells rubberwood furniture in Malaysia, rest of Asia, North America, Europe, and internationally.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026