Cheetah Holdings Berhad's (KLSE:CHEETAH) Financials Are Too Obscure To Link With Current Share Price Momentum: What's In Store For the Stock?

Cheetah Holdings Berhad (KLSE:CHEETAH) has had a great run on the share market with its stock up by a significant 273% over the last three months. However, we decided to pay attention to the company's fundamentals which don't appear to give a clear sign about the company's financial health. Specifically, we decided to study Cheetah Holdings Berhad's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for Cheetah Holdings Berhad

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Cheetah Holdings Berhad is:

1.8% = RM2.3m ÷ RM129m (Based on the trailing twelve months to December 2020).

The 'return' refers to a company's earnings over the last year. So, this means that for every MYR1 of its shareholder's investments, the company generates a profit of MYR0.02.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Cheetah Holdings Berhad's Earnings Growth And 1.8% ROE

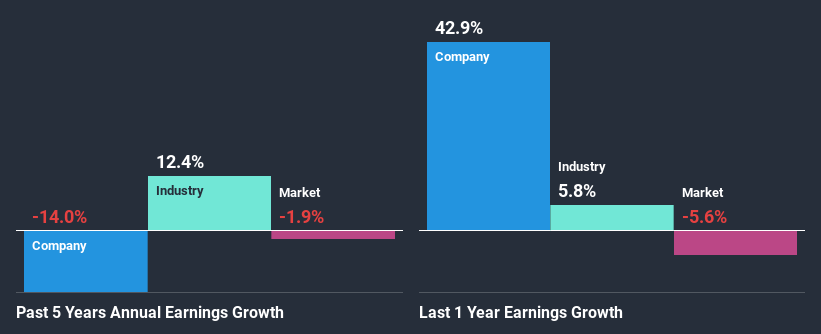

As you can see, Cheetah Holdings Berhad's ROE looks pretty weak. Even compared to the average industry ROE of 6.6%, the company's ROE is quite dismal. Given the circumstances, the significant decline in net income by 14% seen by Cheetah Holdings Berhad over the last five years is not surprising. We believe that there also might be other aspects that are negatively influencing the company's earnings prospects. For example, the business has allocated capital poorly, or that the company has a very high payout ratio.

However, when we compared Cheetah Holdings Berhad's growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 12% in the same period. This is quite worrisome.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Cheetah Holdings Berhad's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Cheetah Holdings Berhad Making Efficient Use Of Its Profits?

While the company did payout a portion of its dividend in the past, it currently doesn't pay a dividend. This implies that potentially all of its profits are being reinvested in the business.

Conclusion

In total, we're a bit ambivalent about Cheetah Holdings Berhad's performance. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. Wrapping up, we would proceed with caution with this company and one way of doing that would be to look at the risk profile of the business. You can see the 3 risks we have identified for Cheetah Holdings Berhad by visiting our risks dashboard for free on our platform here.

If you’re looking to trade Cheetah Holdings Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:CHEETAH

Cheetah Holdings Berhad

An investment holding company, designs, develops, markets, and deals various garments, apparels, and ancillary products in Malaysia.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026