- Malaysia

- /

- Commercial Services

- /

- KLSE:NGGB

How Much Of Nextgreen Global Berhad (KLSE:NGGB) Do Insiders Own?

A look at the shareholders of Nextgreen Global Berhad (KLSE:NGGB) can tell us which group is most powerful. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.

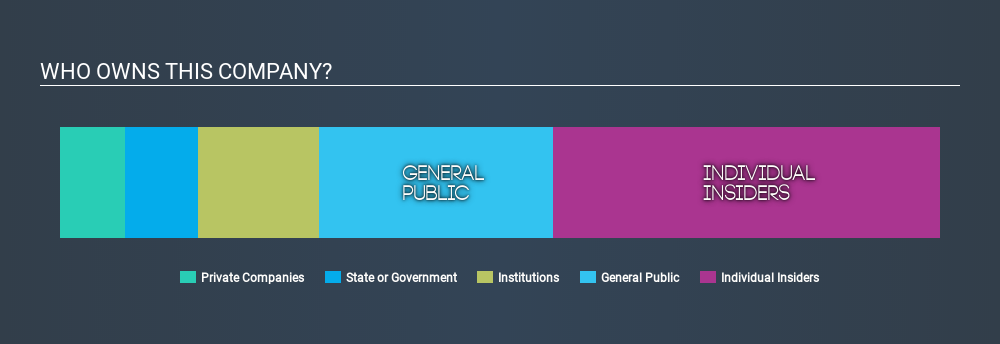

With a market capitalization of RM138m, Nextgreen Global Berhad is a small cap stock, so it might not be well known by many institutional investors. Our analysis of the ownership of the company, below, shows that institutional investors have bought into the company. Let's delve deeper into each type of owner, to discover more about Nextgreen Global Berhad.

See our latest analysis for Nextgreen Global Berhad

What Does The Institutional Ownership Tell Us About Nextgreen Global Berhad?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

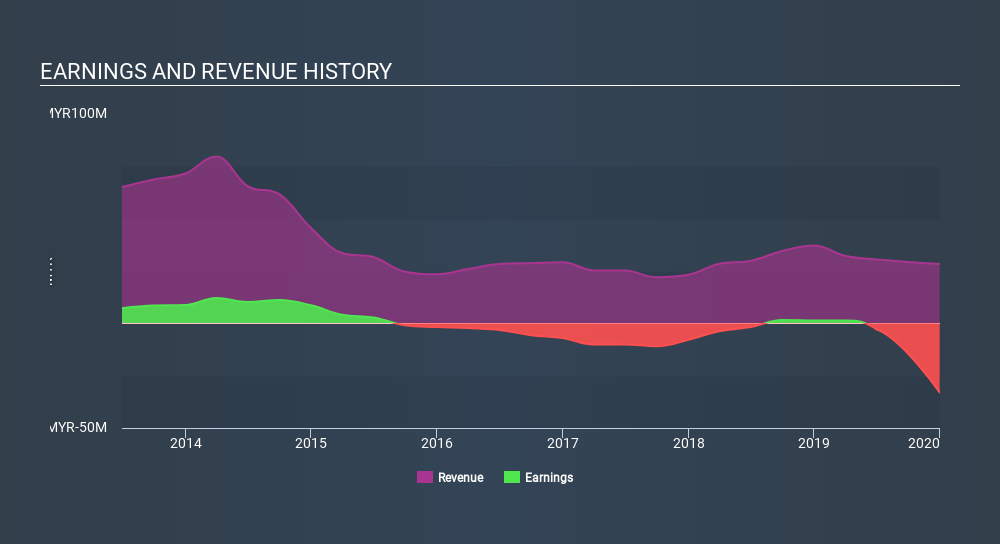

Nextgreen Global Berhad already has institutions on the share registry. Indeed, they own 14% of the company. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Nextgreen Global Berhad's historic earnings and revenue, below, but keep in mind there's always more to the story.

We note that hedge funds don't have a meaningful investment in Nextgreen Global Berhad. With a 13% stake, CEO Thiam Lim is the largest shareholder. The second and third largest shareholders are Kong Hiok Gan and Bank of China Investment Management Co., Ltd., each holding around 8.5% of the shares outstanding.

On studying the facts and figures more closely, we found that 7 of the top shareholders account for 54% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests somewhat.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. Our information suggests that there isn't any analyst coverage of the stock, so it is probably little known.

Insider Ownership Of Nextgreen Global Berhad

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our most recent data indicates that insiders own a reasonable proportion of Nextgreen Global Berhad. Insiders have a RM61m stake in this RM138m business. I would say this shows alignment with shareholders, but it is worth noting that the company is still quite small; some insiders may have founded the business. You can click here to see if those insiders have been buying or selling.

General Public Ownership

With a 27% ownership, the general public have some degree of sway over NGGB. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Company Ownership

It seems that Private Companies own 7.5%, of the NGGB stock. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 5 warning signs we've spotted with Nextgreen Global Berhad (including 2 which is are a bit concerning) .

If you would prefer check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, backed by strong financial data.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About KLSE:NGGB

Nextgreen Global Berhad

An investment holding company, engages in printing and publishing business in Malaysia, China, France, Singapore, and the United States.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives