- Malaysia

- /

- Commercial Services

- /

- KLSE:CYPARK

Even though Cypark Resources Berhad (KLSE:CYPARK) has lost RM82m market cap in last 7 days, shareholders are still up 105% over 3 years

The Cypark Resources Berhad (KLSE:CYPARK) share price has had a bad week, falling 11%. But in three years the returns have been great. Indeed, the share price is up a very strong 105% in that time. After a run like that some may not be surprised to see prices moderate. The thing to consider is whether the underlying business is doing well enough to support the current price.

In light of the stock dropping 11% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive three-year return.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

We know that Cypark Resources Berhad has been profitable in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. So it might be better to look at other metrics to try to understand the share price.

You can only imagine how long term shareholders feel about the declining revenue trend (slipping at 17% per year). The only thing that's clear is there is low correlation between Cypark Resources Berhad's share price and its historic fundamental data. Further research may be required!

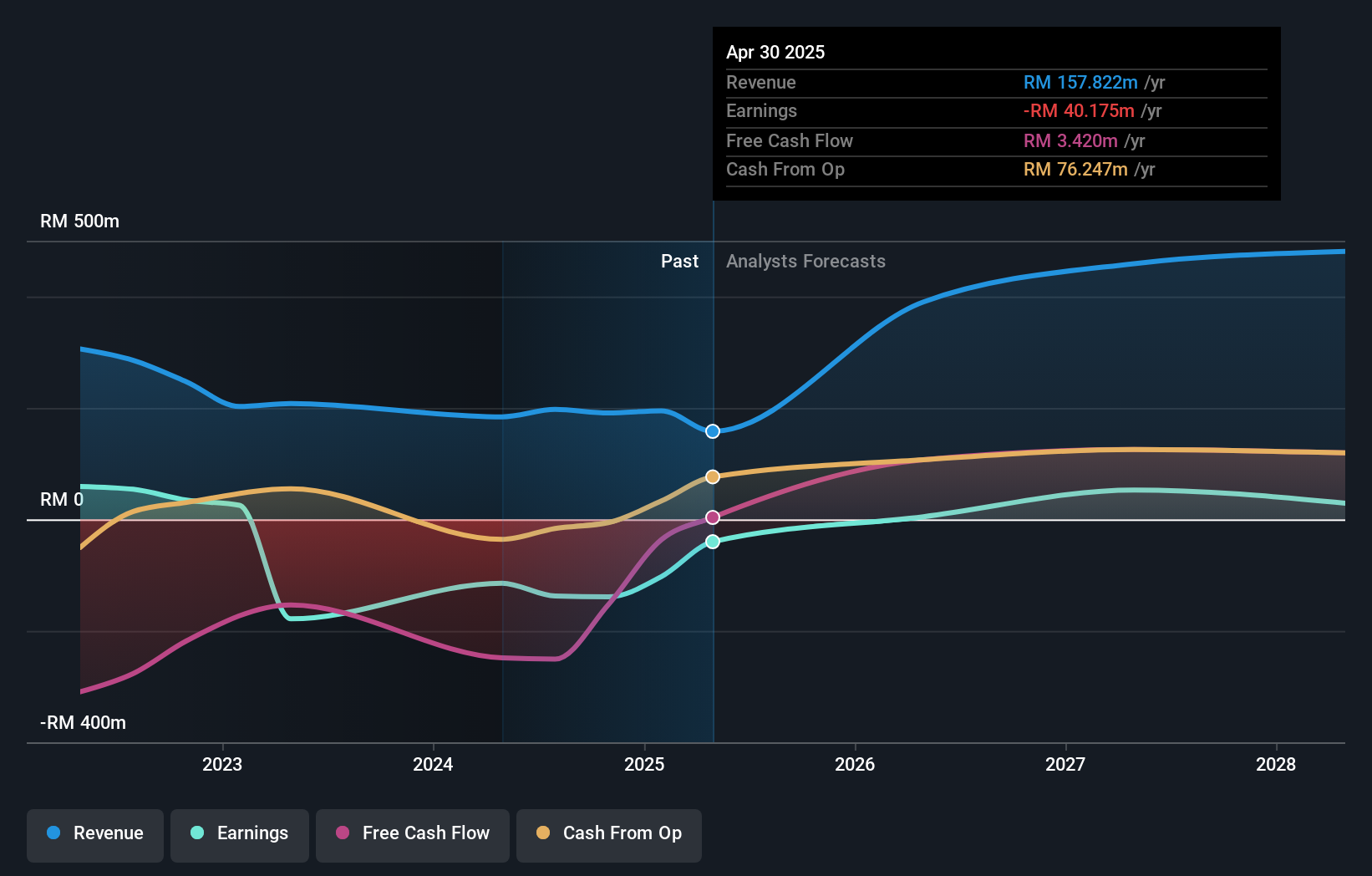

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Cypark Resources Berhad stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Cypark Resources Berhad shareholders have received a total shareholder return of 3.1% over one year. That certainly beats the loss of about 2% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for Cypark Resources Berhad that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CYPARK

Cypark Resources Berhad

Engages in the renewable energy, construction, engineering, green technology, environment, waste management, and waste-to-energy (WTE) businesses in Malaysia.

High growth potential and fair value.

Market Insights

Community Narratives