- Malaysia

- /

- Commercial Services

- /

- KLSE:CGB

Central Global Berhad (KLSE:CGB) Seems To Use Debt Quite Sensibly

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Central Global Berhad (KLSE:CGB) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Central Global Berhad

What Is Central Global Berhad's Net Debt?

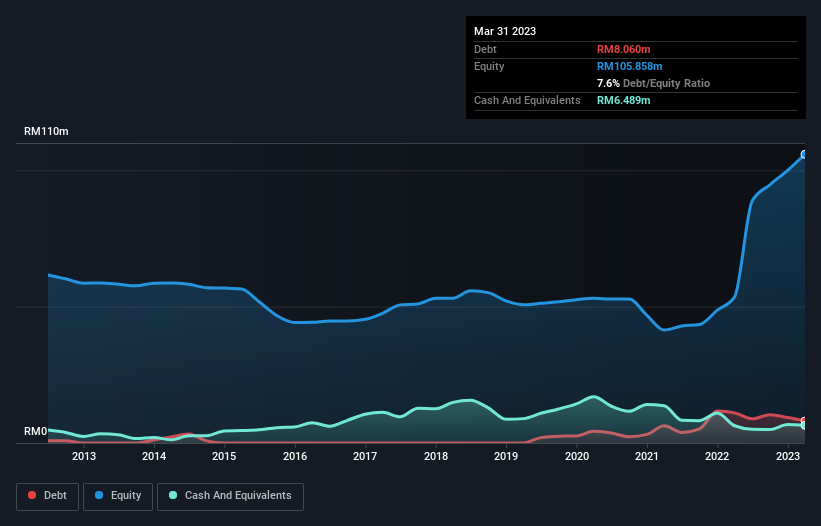

The image below, which you can click on for greater detail, shows that Central Global Berhad had debt of RM8.06m at the end of March 2023, a reduction from RM11.1m over a year. However, because it has a cash reserve of RM6.49m, its net debt is less, at about RM1.57m.

A Look At Central Global Berhad's Liabilities

We can see from the most recent balance sheet that Central Global Berhad had liabilities of RM87.2m falling due within a year, and liabilities of RM3.08m due beyond that. On the other hand, it had cash of RM6.49m and RM89.2m worth of receivables due within a year. So it can boast RM5.35m more liquid assets than total liabilities.

This short term liquidity is a sign that Central Global Berhad could probably pay off its debt with ease, as its balance sheet is far from stretched. But either way, Central Global Berhad has virtually no net debt, so it's fair to say it does not have a heavy debt load!

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Central Global Berhad has very little debt (net of cash), and boasts a debt to EBITDA ratio of 0.072 and EBIT of 48.8 times the interest expense. So relative to past earnings, the debt load seems trivial. It was also good to see that despite losing money on the EBIT line last year, Central Global Berhad turned things around in the last 12 months, delivering and EBIT of RM21m. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Central Global Berhad will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. During the last year, Central Global Berhad burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Central Global Berhad's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered were considerably better. There's no doubt that its ability to to cover its interest expense with its EBIT is pretty flash. When we consider all the elements mentioned above, it seems to us that Central Global Berhad is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Central Global Berhad (1 is significant) you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CGB

Central Global Berhad

An investment holding company, engages in construction activities in Malaysia, rest of Asia, Australia, the United States, Europe, and internationally.

Exceptional growth potential with mediocre balance sheet.