- Malaysia

- /

- Trade Distributors

- /

- KLSE:TSA

Fewer Investors Than Expected Jumping On TSA Group Berhad (KLSE:TSA)

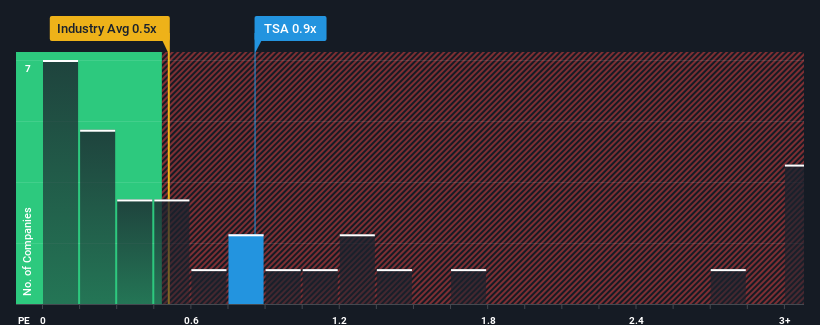

There wouldn't be many who think TSA Group Berhad's (KLSE:TSA) price-to-sales (or "P/S") ratio of 0.9x is worth a mention when the median P/S for the Trade Distributors industry in Malaysia is similar at about 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for TSA Group Berhad

What Does TSA Group Berhad's P/S Mean For Shareholders?

For example, consider that TSA Group Berhad's financial performance has been poor lately as its revenue has been in decline. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for TSA Group Berhad, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like TSA Group Berhad's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 6.9% decrease to the company's top line. Even so, admirably revenue has lifted 42% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 6.0%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that TSA Group Berhad is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On TSA Group Berhad's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that TSA Group Berhad currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You need to take note of risks, for example - TSA Group Berhad has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If these risks are making you reconsider your opinion on TSA Group Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if TSA Group Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:TSA

TSA Group Berhad

An investment holding company, engages in the distribution and supply of ferrous and non-ferrous metal, and other industrial hardware products in Malaysia, Singapore, Bangladesh, Thailand, Indonesia, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives