- Malaysia

- /

- Industrials

- /

- KLSE:TANCO

Tanco Holdings Berhad's (KLSE:TANCO) Stock Has Seen Strong Momentum: Does That Call For Deeper Study Of Its Financial Prospects?

Tanco Holdings Berhad (KLSE:TANCO) has had a great run on the share market with its stock up by a significant 24% over the last month. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. Specifically, we decided to study Tanco Holdings Berhad's ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company's success at turning shareholder investments into profits.

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Tanco Holdings Berhad is:

3.3% = RM12m ÷ RM366m (Based on the trailing twelve months to June 2025).

The 'return' is the income the business earned over the last year. So, this means that for every MYR1 of its shareholder's investments, the company generates a profit of MYR0.03.

View our latest analysis for Tanco Holdings Berhad

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Tanco Holdings Berhad's Earnings Growth And 3.3% ROE

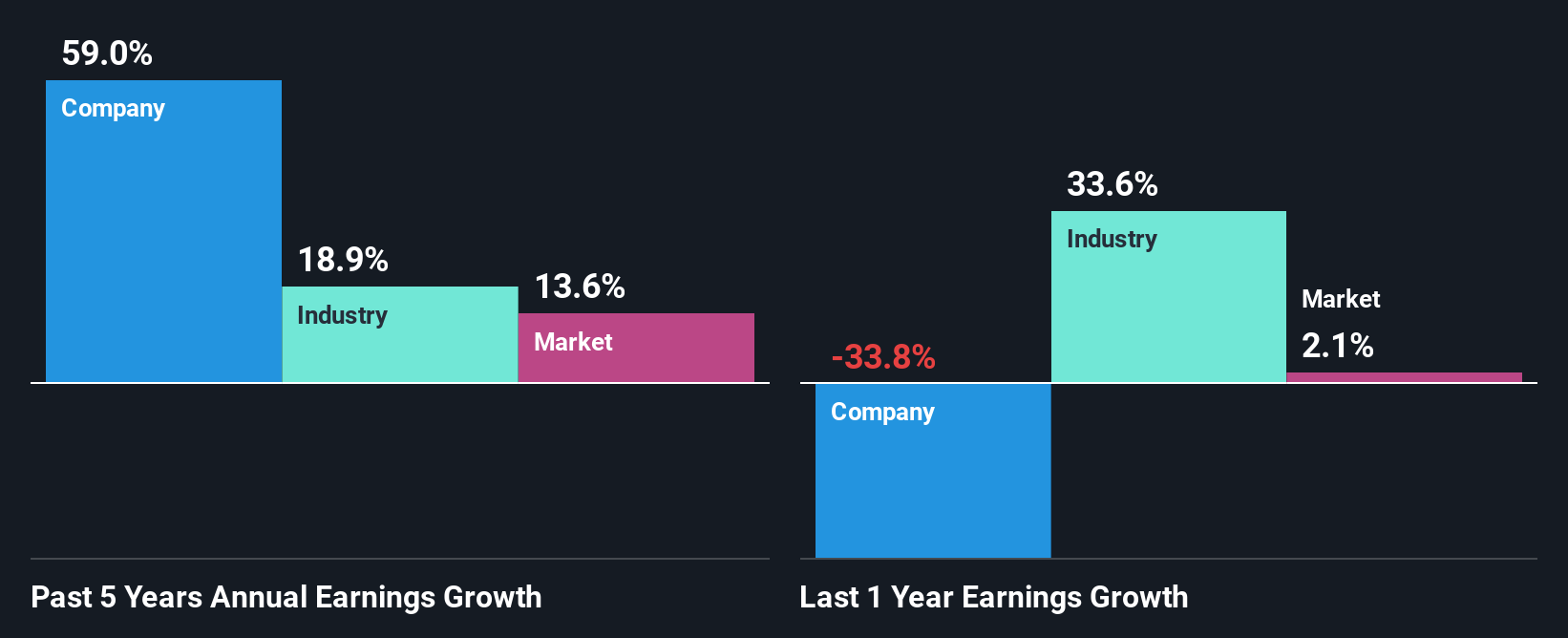

It is quite clear that Tanco Holdings Berhad's ROE is rather low. Even compared to the average industry ROE of 9.3%, the company's ROE is quite dismal. Despite this, surprisingly, Tanco Holdings Berhad saw an exceptional 59% net income growth over the past five years. Therefore, there could be other reasons behind this growth. For instance, the company has a low payout ratio or is being managed efficiently.

We then compared Tanco Holdings Berhad's net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 19% in the same 5-year period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Tanco Holdings Berhad fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Tanco Holdings Berhad Efficiently Re-investing Its Profits?

Tanco Holdings Berhad doesn't pay any regular dividends currently which essentially means that it has been reinvesting all of its profits into the business. This definitely contributes to the high earnings growth number that we discussed above.

Summary

On the whole, we do feel that Tanco Holdings Berhad has some positive attributes. With a high rate of reinvestment, albeit at a low ROE, the company has managed to see a considerable growth in its earnings. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. To know the 1 risk we have identified for Tanco Holdings Berhad visit our risks dashboard for free.

Valuation is complex, but we're here to simplify it.

Discover if Tanco Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:TANCO

Tanco Holdings Berhad

An investment holding company, engages in the property development business primarily in Malaysia.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives