- Malaysia

- /

- Trade Distributors

- /

- KLSE:SCC

SCC Holdings Berhad (KLSE:SCC) Looks Just Right With A 28% Price Jump

SCC Holdings Berhad (KLSE:SCC) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 14% in the last twelve months.

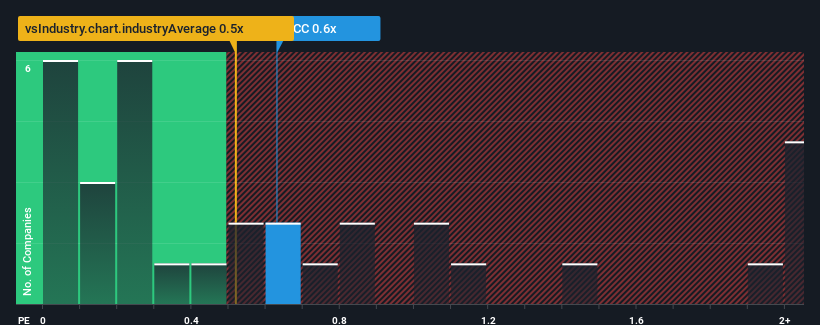

Even after such a large jump in price, it's still not a stretch to say that SCC Holdings Berhad's price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" compared to the Trade Distributors industry in Malaysia, where the median P/S ratio is around 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for SCC Holdings Berhad

What Does SCC Holdings Berhad's P/S Mean For Shareholders?

The recent revenue growth at SCC Holdings Berhad would have to be considered satisfactory if not spectacular. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. Those who are bullish on SCC Holdings Berhad will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on SCC Holdings Berhad's earnings, revenue and cash flow.How Is SCC Holdings Berhad's Revenue Growth Trending?

SCC Holdings Berhad's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.3% last year. The latest three year period has also seen a 19% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

It's interesting to note that the rest of the industry is similarly expected to grow by 5.5% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's understandable that SCC Holdings Berhad's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Bottom Line On SCC Holdings Berhad's P/S

SCC Holdings Berhad's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we've seen, SCC Holdings Berhad's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

You should always think about risks. Case in point, we've spotted 5 warning signs for SCC Holdings Berhad you should be aware of, and 3 of them don't sit too well with us.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SCC

SCC Holdings Berhad

An investment holding company, engages in the distribution, marketing, and sale of food service equipment and animal health products in Malaysia.

Flawless balance sheet moderate.

Similar Companies

Market Insights

Community Narratives