- Malaysia

- /

- Trade Distributors

- /

- KLSE:SAMCHEM

Samchem Holdings Berhad's (KLSE:SAMCHEM) Earnings Are Growing But Is There More To The Story?

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. In this article, we'll look at how useful this year's statutory profit is, when analysing Samchem Holdings Berhad (KLSE:SAMCHEM).

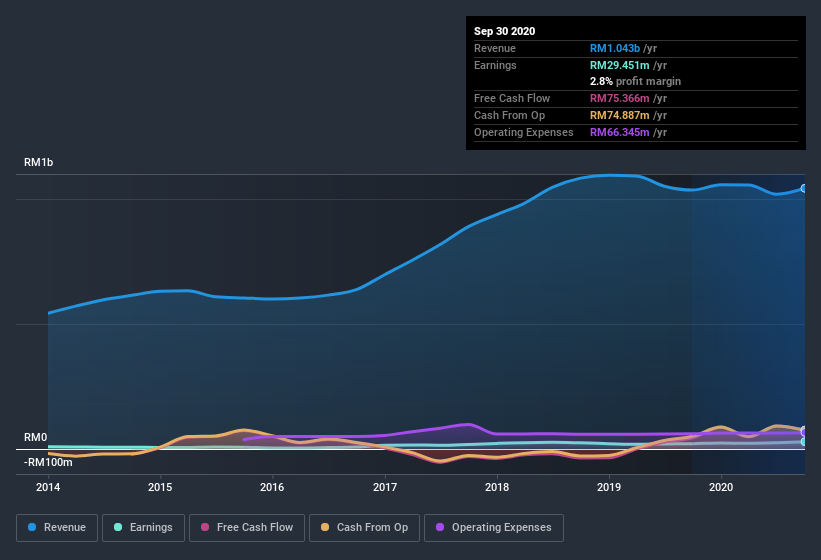

We like the fact that Samchem Holdings Berhad made a profit of RM29.5m on its revenue of RM1.04b, in the last year. One positive is that it has grown both its profit and its revenue, over the last few years.

Check out our latest analysis for Samchem Holdings Berhad

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. As a result, we think it's well worth considering what Samchem Holdings Berhad's cashflow (when compared to its earnings) can tell us about the nature of its statutory profit. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Examining Cashflow Against Samchem Holdings Berhad's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

For the year to September 2020, Samchem Holdings Berhad had an accrual ratio of -0.16. That indicates that its free cash flow quite significantly exceeded its statutory profit. In fact, it had free cash flow of RM75m in the last year, which was a lot more than its statutory profit of RM29.5m. Samchem Holdings Berhad shareholders are no doubt pleased that free cash flow improved over the last twelve months.

Our Take On Samchem Holdings Berhad's Profit Performance

Samchem Holdings Berhad's accrual ratio is solid, and indicates strong free cash flow, as we discussed, above. Because of this, we think Samchem Holdings Berhad's earnings potential is at least as good as it seems, and maybe even better! And the EPS is up 61% annually, over the last three years. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you'd like to know more about Samchem Holdings Berhad as a business, it's important to be aware of any risks it's facing. At Simply Wall St, we found 3 warning signs for Samchem Holdings Berhad and we think they deserve your attention.

Today we've zoomed in on a single data point to better understand the nature of Samchem Holdings Berhad's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you decide to trade Samchem Holdings Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Samchem Holdings Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:SAMCHEM

Samchem Holdings Berhad

An investment holding company, distributes industrial chemicals in Malaysia, Indonesia, Vietnam, and Singapore.

Excellent balance sheet slight.

Market Insights

Community Narratives