- Malaysia

- /

- Construction

- /

- KLSE:SAMAIDEN

Samaiden Group Berhad's (KLSE:SAMAIDEN) Popularity With Investors Is Under Threat From Overpricing

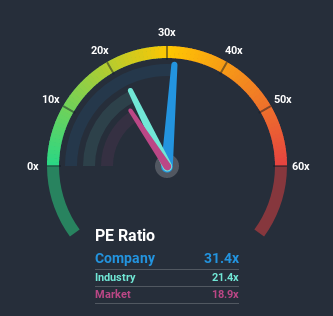

Samaiden Group Berhad's (KLSE:SAMAIDEN) price-to-earnings (or "P/E") ratio of 31.4x might make it look like a strong sell right now compared to the market in Malaysia, where around half of the companies have P/E ratios below 18x and even P/E's below 12x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times have been more advantageous for Samaiden Group Berhad as its earnings haven't fallen as much as the rest of the market. It seems that many are expecting the comparatively superior earnings performance to persist, which has increased investors’ willingness to pay up for the stock. While you'd prefer that its earnings trajectory turned around, you'd at least be hoping it remains less negative than other companies, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Samaiden Group Berhad

Does Growth Match The High P/E?

In order to justify its P/E ratio, Samaiden Group Berhad would need to produce outstanding growth well in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 3.0%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 432% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to slump, contracting by 32% during the coming year according to the five analysts following the company. That's not great when the rest of the market is expected to grow by 28%.

In light of this, it's alarming that Samaiden Group Berhad's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Samaiden Group Berhad currently trades on a much higher than expected P/E for a company whose earnings are forecast to decline. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings are highly unlikely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Samaiden Group Berhad that you should be aware of.

If these risks are making you reconsider your opinion on Samaiden Group Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you decide to trade Samaiden Group Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:SAMAIDEN

Samaiden Group Berhad

An investment holding company, provides engineering, procurement, construction, and commissioning of solar photovoltaic systems and power plants, and biomass power plants in Malaysia, Singapore, and Cambodia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives