- Malaysia

- /

- Construction

- /

- KLSE:KIMLUN

Here's Why We Think Kimlun Corporation Berhad's (KLSE:KIMLUN) CEO Compensation Looks Fair for the time being

Key Insights

- Kimlun Corporation Berhad will host its Annual General Meeting on 4th of June

- Total pay for CEO Tian Sim includes RM677.6k salary

- The total compensation is similar to the average for the industry

- Kimlun Corporation Berhad's EPS declined by 5.2% over the past three years while total shareholder return over the past three years was 69%

Kimlun Corporation Berhad (KLSE:KIMLUN) has exhibited strong share price growth in the past few years. However, its earnings growth has not kept up, suggesting that there may be something amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 4th of June. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

See our latest analysis for Kimlun Corporation Berhad

How Does Total Compensation For Tian Sim Compare With Other Companies In The Industry?

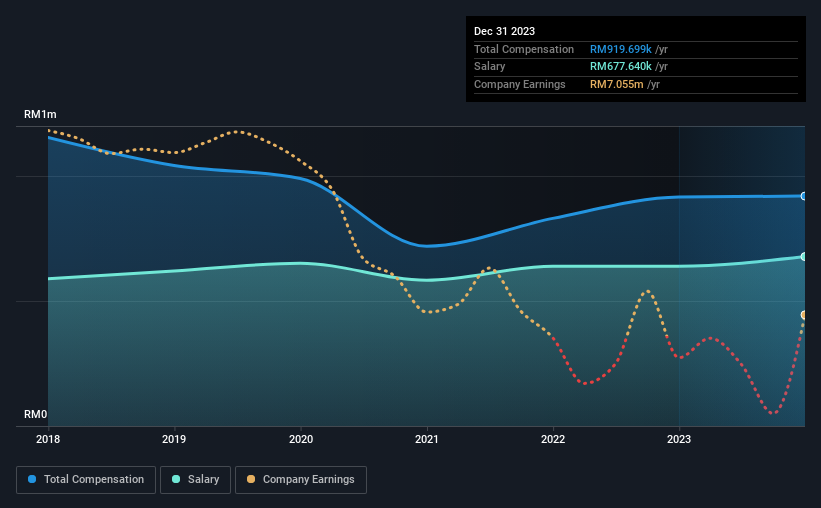

According to our data, Kimlun Corporation Berhad has a market capitalization of RM495m, and paid its CEO total annual compensation worth RM920k over the year to December 2023. This means that the compensation hasn't changed much from last year. Notably, the salary which is RM677.6k, represents most of the total compensation being paid.

In comparison with other companies in the Malaysian Construction industry with market capitalizations under RM939m, the reported median total CEO compensation was RM723k. This suggests that Kimlun Corporation Berhad remunerates its CEO largely in line with the industry average. What's more, Tian Sim holds RM13m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | RM678k | RM639k | 74% |

| Other | RM242k | RM277k | 26% |

| Total Compensation | RM920k | RM916k | 100% |

Talking in terms of the industry, salary represented approximately 77% of total compensation out of all the companies we analyzed, while other remuneration made up 23% of the pie. Our data reveals that Kimlun Corporation Berhad allocates salary more or less in line with the wider market. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Kimlun Corporation Berhad's Growth

Kimlun Corporation Berhad has reduced its earnings per share by 5.2% a year over the last three years. Its revenue is up 13% over the last year.

Few shareholders would be pleased to read that EPS have declined. And while it's good to see some good revenue growth recently, the growth isn't really fast enough for us to put aside my concerns around EPS. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Kimlun Corporation Berhad Been A Good Investment?

Boasting a total shareholder return of 69% over three years, Kimlun Corporation Berhad has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean returns may be hard to keep up. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Kimlun Corporation Berhad that you should be aware of before investing.

Switching gears from Kimlun Corporation Berhad, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if Kimlun Corporation Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KIMLUN

Kimlun Corporation Berhad

An investment holding company, provides engineering and construction services in Malaysia and Singapore.

Solid track record and fair value.

Market Insights

Community Narratives