- Malaysia

- /

- Construction

- /

- KLSE:IJM

Here's Why IJM Corporation Berhad (KLSE:IJM) Has A Meaningful Debt Burden

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies IJM Corporation Berhad (KLSE:IJM) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Our analysis indicates that IJM is potentially overvalued!

What Is IJM Corporation Berhad's Debt?

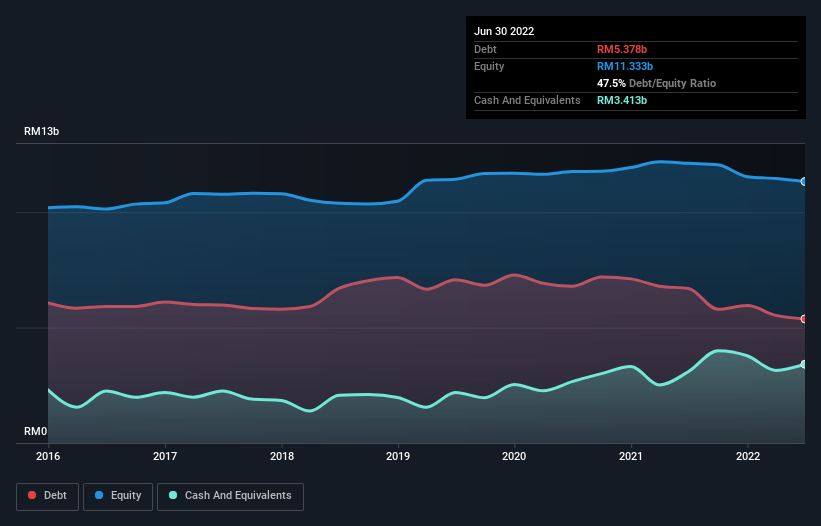

The image below, which you can click on for greater detail, shows that IJM Corporation Berhad had debt of RM5.38b at the end of June 2022, a reduction from RM6.69b over a year. However, it does have RM3.41b in cash offsetting this, leading to net debt of about RM1.97b.

How Strong Is IJM Corporation Berhad's Balance Sheet?

We can see from the most recent balance sheet that IJM Corporation Berhad had liabilities of RM4.86b falling due within a year, and liabilities of RM4.67b due beyond that. On the other hand, it had cash of RM3.41b and RM1.89b worth of receivables due within a year. So it has liabilities totalling RM4.23b more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of RM5.20b. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

IJM Corporation Berhad's net debt is sitting at a very reasonable 2.1 times its EBITDA, while its EBIT covered its interest expense just 3.2 times last year. While these numbers do not alarm us, it's worth noting that the cost of the company's debt is having a real impact. Importantly, IJM Corporation Berhad's EBIT fell a jaw-dropping 30% in the last twelve months. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine IJM Corporation Berhad's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Happily for any shareholders, IJM Corporation Berhad actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

We'd go so far as to say IJM Corporation Berhad's EBIT growth rate was disappointing. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making IJM Corporation Berhad stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for IJM Corporation Berhad you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:IJM

IJM Corporation Berhad

Engages in the construction business in Malaysia, India, and the United Kingdom.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives