- Malaysia

- /

- Construction

- /

- KLSE:GADANG

Gadang Holdings Berhad's (KLSE:GADANG) 33% Jump Shows Its Popularity With Investors

Gadang Holdings Berhad (KLSE:GADANG) shareholders would be excited to see that the share price has had a great month, posting a 33% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 5.9% in the last twelve months.

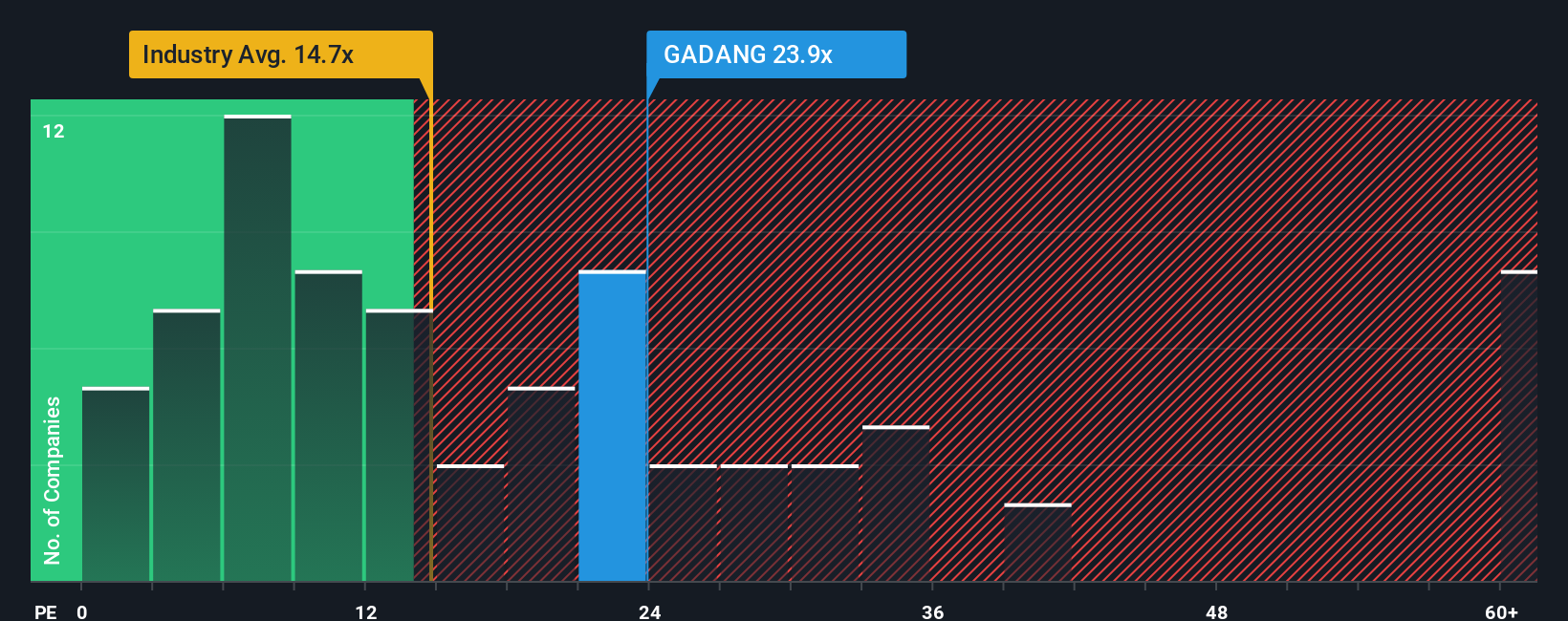

Following the firm bounce in price, Gadang Holdings Berhad may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 23.9x, since almost half of all companies in Malaysia have P/E ratios under 15x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's superior to most other companies of late, Gadang Holdings Berhad has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Gadang Holdings Berhad

Is There Enough Growth For Gadang Holdings Berhad?

In order to justify its P/E ratio, Gadang Holdings Berhad would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 107%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 77% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 18% per year over the next three years. With the market only predicted to deliver 12% per year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Gadang Holdings Berhad's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Gadang Holdings Berhad's P/E?

The strong share price surge has got Gadang Holdings Berhad's P/E rushing to great heights as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Gadang Holdings Berhad maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Gadang Holdings Berhad that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:GADANG

Gadang Holdings Berhad

An investment holding company, engages in civil engineering and construction, property development, water supply, and mechanical and electrical engineering businesses in Malaysia, Indonesia, and Singapore.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives