Is Favelle Favco Berhad (KLSE:FAVCO) Using Too Much Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Favelle Favco Berhad (KLSE:FAVCO) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Favelle Favco Berhad

What Is Favelle Favco Berhad's Net Debt?

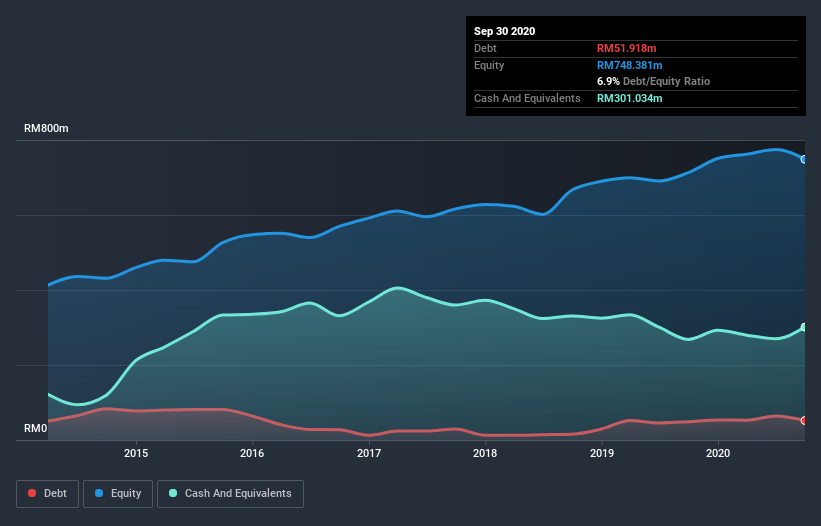

As you can see below, at the end of September 2020, Favelle Favco Berhad had RM51.9m of debt, up from RM48.7m a year ago. Click the image for more detail. However, its balance sheet shows it holds RM301.0m in cash, so it actually has RM249.1m net cash.

How Healthy Is Favelle Favco Berhad's Balance Sheet?

The latest balance sheet data shows that Favelle Favco Berhad had liabilities of RM510.2m due within a year, and liabilities of RM57.6m falling due after that. Offsetting these obligations, it had cash of RM301.0m as well as receivables valued at RM308.1m due within 12 months. So it can boast RM41.3m more liquid assets than total liabilities.

This surplus suggests that Favelle Favco Berhad has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Favelle Favco Berhad has more cash than debt is arguably a good indication that it can manage its debt safely.

It is just as well that Favelle Favco Berhad's load is not too heavy, because its EBIT was down 24% over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Favelle Favco Berhad's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Favelle Favco Berhad has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last three years, Favelle Favco Berhad created free cash flow amounting to 16% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Summing up

While it is always sensible to investigate a company's debt, in this case Favelle Favco Berhad has RM249.1m in net cash and a decent-looking balance sheet. So we don't have any problem with Favelle Favco Berhad's use of debt. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check Favelle Favco Berhad's dividend history, without delay!

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade Favelle Favco Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:FAVCO

Favelle Favco Berhad

An investment holding company, engages in the manufacturing of cranes and lifting solutions under the Favelle Favco and Kroll brands in Malaysia and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives