- Malaysia

- /

- Trade Distributors

- /

- KLSE:ENGTEX

Engtex Group Berhad (KLSE:ENGTEX) Stocks Shoot Up 35% But Its P/S Still Looks Reasonable

Despite an already strong run, Engtex Group Berhad (KLSE:ENGTEX) shares have been powering on, with a gain of 35% in the last thirty days. The last 30 days bring the annual gain to a very sharp 42%.

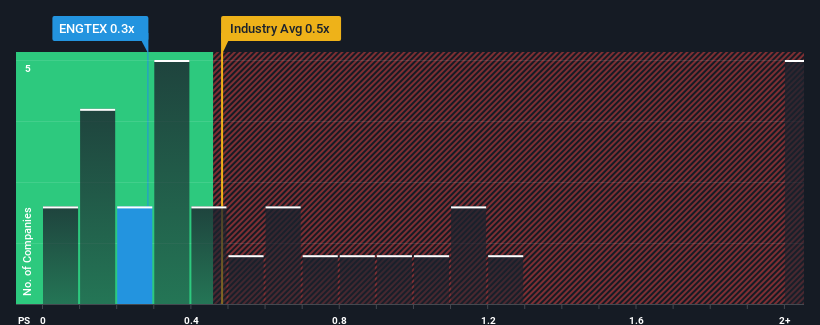

Even after such a large jump in price, it's still not a stretch to say that Engtex Group Berhad's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Trade Distributors industry in Malaysia, where the median P/S ratio is around 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Engtex Group Berhad

How Has Engtex Group Berhad Performed Recently?

While the industry has experienced revenue growth lately, Engtex Group Berhad's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Engtex Group Berhad will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Engtex Group Berhad would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.1%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 51% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 3.0% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 2.8%, which is not materially different.

With this in mind, it makes sense that Engtex Group Berhad's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Engtex Group Berhad's P/S?

Engtex Group Berhad appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that Engtex Group Berhad maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

Plus, you should also learn about these 3 warning signs we've spotted with Engtex Group Berhad (including 1 which doesn't sit too well with us).

If you're unsure about the strength of Engtex Group Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Engtex Group Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ENGTEX

Engtex Group Berhad

Engages in the wholesale and distribution of pipes, valves, fittings, plumbing materials, steel related products, general hardware products, and construction materials in Malaysia.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives