- Malaysia

- /

- Construction

- /

- KLSE:EKOVEST

We Discuss Why Ekovest Berhad's (KLSE:EKOVEST) CEO Will Find It Hard To Get A Pay Rise From Shareholders This Year

Key Insights

- Ekovest Berhad's Annual General Meeting to take place on 15th of December

- Total pay for CEO Keng Lim includes RM180.0k salary

- The overall pay is 80% below the industry average

- Ekovest Berhad's three-year loss to shareholders was 18% while its EPS was down 82% over the past three years

The underwhelming performance at Ekovest Berhad (KLSE:EKOVEST) recently has probably not pleased shareholders. The next AGM coming up on 15th of December will be a chance for shareholders to have their concerns addressed by the board, challenge management on company strategy and vote on resolutions such as executive remuneration, which may help change the company's future prospects. The data we gathered below shows that CEO compensation looks acceptable for now.

See our latest analysis for Ekovest Berhad

How Does Total Compensation For Keng Lim Compare With Other Companies In The Industry?

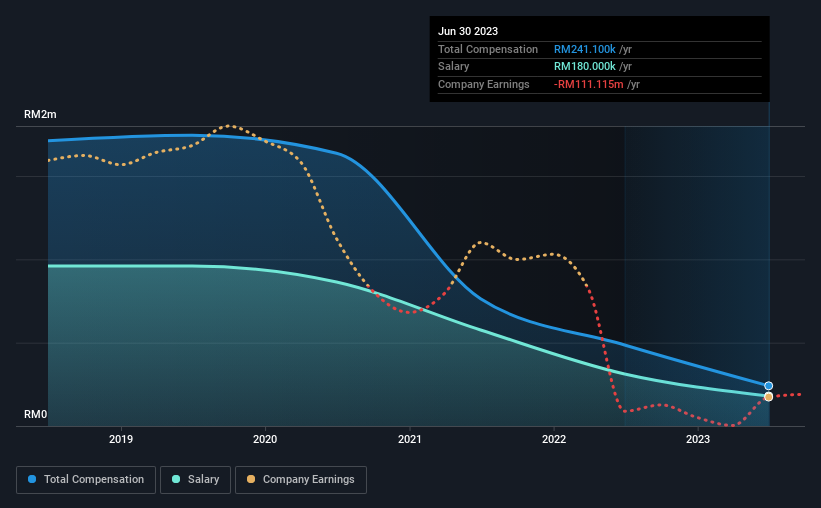

Our data indicates that Ekovest Berhad has a market capitalization of RM1.3b, and total annual CEO compensation was reported as RM241k for the year to June 2023. Notably, that's a decrease of 50% over the year before. In particular, the salary of RM180.0k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the Malaysian Construction industry with market capitalizations ranging between RM466m and RM1.9b had a median total CEO compensation of RM1.2m. In other words, Ekovest Berhad pays its CEO lower than the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | RM180k | RM312k | 75% |

| Other | RM61k | RM174k | 25% |

| Total Compensation | RM241k | RM486k | 100% |

On an industry level, roughly 86% of total compensation represents salary and 14% is other remuneration. Ekovest Berhad sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Ekovest Berhad's Growth Numbers

Over the last three years, Ekovest Berhad has shrunk its earnings per share by 82% per year. In the last year, its revenue is up 12%.

The decline in EPS is a bit concerning. There's no doubt that the silver lining is that revenue is up. But it isn't sufficiently fast growth to overlook the fact that EPS has gone backwards over three years. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Ekovest Berhad Been A Good Investment?

With a three year total loss of 18% for the shareholders, Ekovest Berhad would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 2 warning signs for Ekovest Berhad you should be aware of, and 1 of them is potentially serious.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Ekovest Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:EKOVEST

Ekovest Berhad

An investment holding company, engages in civil engineering and building works in Malaysia, Indonesia, and the People’s Republic of China.

Slightly overvalued with very low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026