- Malaysia

- /

- Construction

- /

- KLSE:CRESBLD

How Does Crest Builder Holdings Berhad's (KLSE:CRESBLD) CEO Pay Compare With Company Performance?

This article will reflect on the compensation paid to Eric Yong who has served as CEO of Crest Builder Holdings Berhad (KLSE:CRESBLD) since 2015. This analysis will also assess whether Crest Builder Holdings Berhad pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Crest Builder Holdings Berhad

How Does Total Compensation For Eric Yong Compare With Other Companies In The Industry?

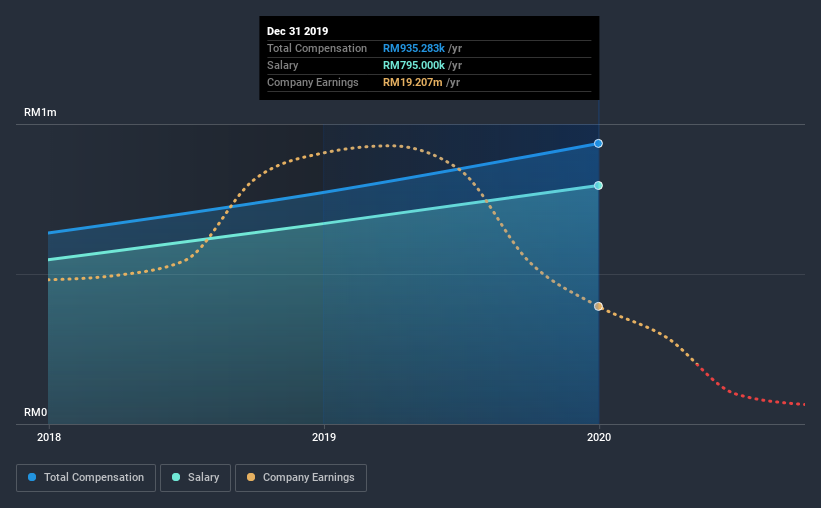

Our data indicates that Crest Builder Holdings Berhad has a market capitalization of RM129m, and total annual CEO compensation was reported as RM935k for the year to December 2019. We note that's an increase of 21% above last year. Notably, the salary which is RM795.0k, represents most of the total compensation being paid.

On comparing similar-sized companies in the industry with market capitalizations below RM815m, we found that the median total CEO compensation was RM902k. So it looks like Crest Builder Holdings Berhad compensates Eric Yong in line with the median for the industry.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | RM795k | RM668k | 85% |

| Other | RM140k | RM104k | 15% |

| Total Compensation | RM935k | RM772k | 100% |

Talking in terms of the industry, salary represented approximately 80% of total compensation out of all the companies we analyzed, while other remuneration made up 20% of the pie. Crest Builder Holdings Berhad is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Crest Builder Holdings Berhad's Growth

Over the last three years, Crest Builder Holdings Berhad has shrunk its earnings per share by 37% per year. It saw its revenue drop 44% over the last year.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Crest Builder Holdings Berhad Been A Good Investment?

With a three year total loss of 12% for the shareholders, Crest Builder Holdings Berhad would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

As we noted earlier, Crest Builder Holdings Berhad pays its CEO in line with similar-sized companies belonging to the same industry. Meanwhile, EPS growth and shareholder returns have been in the red for the last three years. It's tough to call out the compensation as inappropriate, but shareholders might not favor a raise before company performance improves.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 4 warning signs for Crest Builder Holdings Berhad you should be aware of, and 1 of them can't be ignored.

Switching gears from Crest Builder Holdings Berhad, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Crest Builder Holdings Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:CRESBLD

Crest Builder Holdings Berhad

An investment holding company, operates as a construction, and mechanical and electrical (M&E) engineering contractor in Malaysia.

Good value with acceptable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion