After Leaping 55% Chin Hin Group Property Berhad (KLSE:CHGP) Shares Are Not Flying Under The Radar

Chin Hin Group Property Berhad (KLSE:CHGP) shares have continued their recent momentum with a 55% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 78%.

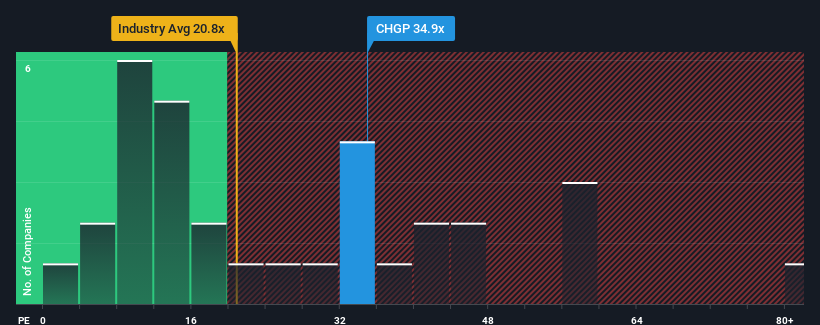

Since its price has surged higher, given close to half the companies in Malaysia have price-to-earnings ratios (or "P/E's") below 16x, you may consider Chin Hin Group Property Berhad as a stock to avoid entirely with its 34.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Chin Hin Group Property Berhad certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Chin Hin Group Property Berhad

Is There Enough Growth For Chin Hin Group Property Berhad?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Chin Hin Group Property Berhad's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 177%. Pleasingly, EPS has also lifted 189% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is only predicted to deliver 17% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we can see why Chin Hin Group Property Berhad is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Key Takeaway

Shares in Chin Hin Group Property Berhad have built up some good momentum lately, which has really inflated its P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Chin Hin Group Property Berhad revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 4 warning signs for Chin Hin Group Property Berhad you should be aware of, and 2 of them shouldn't be ignored.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CHGP

Chin Hin Group Property Berhad

An investment holding company, manufactures, assembles, and trades in rebuilt and new commercial vehicles in Malaysia.

Proven track record with imperfect balance sheet.

Market Insights

Community Narratives