Here's Why CB Industrial Product Holding Berhad (KLSE:CBIP) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in CB Industrial Product Holding Berhad (KLSE:CBIP). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for CB Industrial Product Holding Berhad

CB Industrial Product Holding Berhad's Improving Profits

In the last three years CB Industrial Product Holding Berhad's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. CB Industrial Product Holding Berhad's EPS shot up from RM0.13 to RM0.18; a result that's bound to keep shareholders happy. That's a fantastic gain of 44%.

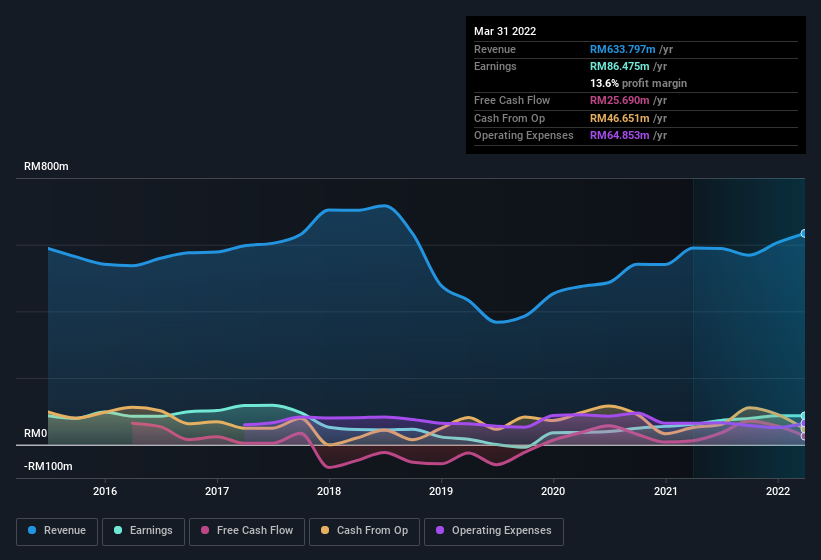

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. CB Industrial Product Holding Berhad shareholders can take confidence from the fact that EBIT margins are up from 7.6% to 9.7%, and revenue is growing. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for CB Industrial Product Holding Berhad?

Are CB Industrial Product Holding Berhad Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So those who are interested in CB Industrial Product Holding Berhad will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Indeed, with a collective holding of 62%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about RM388m riding on the stock, at current prices. That's nothing to sneeze at!

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Our quick analysis into CEO remuneration would seem to indicate they are. Our analysis has discovered that the median total compensation for the CEOs of companies like CB Industrial Product Holding Berhad with market caps under RM882m is about RM497k.

The CB Industrial Product Holding Berhad CEO received total compensation of only RM29k in the year to December 2021. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add CB Industrial Product Holding Berhad To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into CB Industrial Product Holding Berhad's strong EPS growth. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. The overarching message here is that CB Industrial Product Holding Berhad has underlying strengths that make it worth a look at. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for CB Industrial Product Holding Berhad that you should be aware of.

Although CB Industrial Product Holding Berhad certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CBIP

CB Industrial Product Holding Berhad

An investment holding company, manufactures and sells palm oil mill equipment and related spare parts in Indonesia, Malaysia, Papua New Guinea, Thailand, Central America, Africa, Singapore, Liberia, and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives