- Malaysia

- /

- Construction

- /

- KLSE:BPURI

Bina Puri Holdings Bhd's (KLSE:BPURI) Shares Climb 26% But Its Business Is Yet to Catch Up

Bina Puri Holdings Bhd (KLSE:BPURI) shareholders have had their patience rewarded with a 26% share price jump in the last month. The annual gain comes to 160% following the latest surge, making investors sit up and take notice.

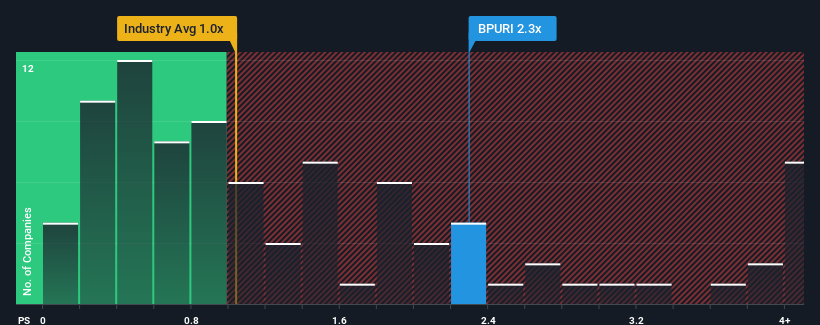

Since its price has surged higher, given close to half the companies operating in Malaysia's Construction industry have price-to-sales ratios (or "P/S") below 1x, you may consider Bina Puri Holdings Bhd as a stock to potentially avoid with its 2.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Bina Puri Holdings Bhd

How Bina Puri Holdings Bhd Has Been Performing

For example, consider that Bina Puri Holdings Bhd's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Bina Puri Holdings Bhd will help you shine a light on its historical performance.How Is Bina Puri Holdings Bhd's Revenue Growth Trending?

Bina Puri Holdings Bhd's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 29%. This means it has also seen a slide in revenue over the longer-term as revenue is down 49% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 12% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's alarming that Bina Puri Holdings Bhd's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Final Word

Bina Puri Holdings Bhd's P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Bina Puri Holdings Bhd currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Bina Puri Holdings Bhd (1 can't be ignored!) that you should be aware of before investing here.

If you're unsure about the strength of Bina Puri Holdings Bhd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Bina Puri Holdings Bhd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bina Puri Holdings Bhd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:BPURI

Bina Puri Holdings Bhd

An investment holding company, engages in the construction and property development businesses in Malaysia and other Asian countries.

Moderate with questionable track record.

Market Insights

Community Narratives