- Malaysia

- /

- Construction

- /

- KLSE:BENALEC

Is Benalec Holdings Berhad (KLSE:BENALEC) Weighed On By Its Debt Load?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Benalec Holdings Berhad (KLSE:BENALEC) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Benalec Holdings Berhad

What Is Benalec Holdings Berhad's Net Debt?

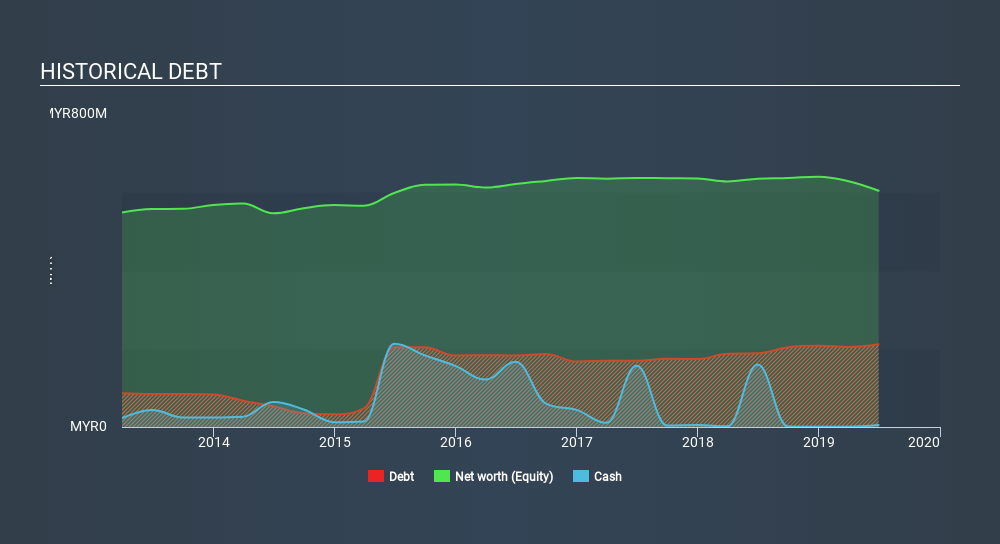

The image below, which you can click on for greater detail, shows that at June 2019 Benalec Holdings Berhad had debt of RM211.6m, up from RM188 in one year. On the flip side, it has RM5.05m in cash leading to net debt of about RM206.6m.

How Healthy Is Benalec Holdings Berhad's Balance Sheet?

According to the last reported balance sheet, Benalec Holdings Berhad had liabilities of RM314.2m due within 12 months, and liabilities of RM191.1m due beyond 12 months. Offsetting this, it had RM5.05m in cash and RM159.4m in receivables that were due within 12 months. So it has liabilities totalling RM340.9m more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the RM118.9m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Benalec Holdings Berhad would probably need a major re-capitalization if its creditors were to demand repayment. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Benalec Holdings Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Benalec Holdings Berhad had negative earnings before interest and tax, and actually shrunk its revenue by 60%, to RM46m. That makes us nervous, to say the least.

Caveat Emptor

Not only did Benalec Holdings Berhad's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost RM990k at the EBIT level. If you consider the significant liabilities mentioned above, we are extremely wary of this investment. Of course, it may be able to improve its situation with a bit of luck and good execution. Nevertheless, we would not bet on it given that it vaporized RM25m in cash over the last twelve months, and it doesn't have much by way of liquid assets. So we consider this a high risk stock and we wouldn't be at all surprised if the company asks shareholders for money before long. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 3 warning signs for Benalec Holdings Berhad you should be aware of, and 1 of them is significant.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About KLSE:BENALEC

Benalec Holdings Berhad

An investment holding company, provides marine construction and civil engineering services in Malaysia.

Flawless balance sheet and good value.