David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Ahmad Zaki Resources Berhad (KLSE:AZRB) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Ahmad Zaki Resources Berhad

How Much Debt Does Ahmad Zaki Resources Berhad Carry?

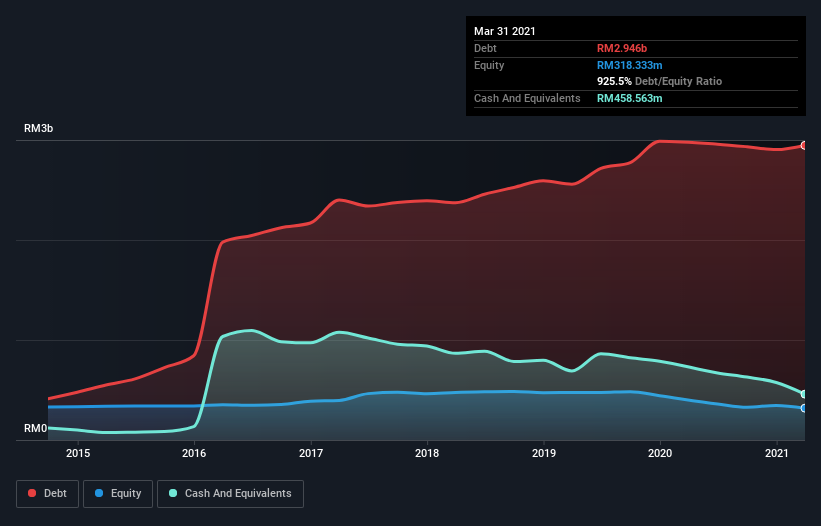

As you can see below, Ahmad Zaki Resources Berhad had RM2.95b of debt, at March 2021, which is about the same as the year before. You can click the chart for greater detail. However, it also had RM458.6m in cash, and so its net debt is RM2.49b.

A Look At Ahmad Zaki Resources Berhad's Liabilities

The latest balance sheet data shows that Ahmad Zaki Resources Berhad had liabilities of RM1.17b due within a year, and liabilities of RM2.93b falling due after that. Offsetting this, it had RM458.6m in cash and RM613.3m in receivables that were due within 12 months. So it has liabilities totalling RM3.03b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the RM158.1m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Ahmad Zaki Resources Berhad would likely require a major re-capitalisation if it had to pay its creditors today. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Ahmad Zaki Resources Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Ahmad Zaki Resources Berhad had a loss before interest and tax, and actually shrunk its revenue by 19%, to RM812m. That's not what we would hope to see.

Caveat Emptor

Not only did Ahmad Zaki Resources Berhad's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Its EBIT loss was a whopping RM56m. When you combine this with the very significant balance sheet liabilities mentioned above, we are so wary of it that we are basically at a loss for the right words. Like every long-shot we're sure it has a glossy presentation outlining its blue-sky potential. But the reality is that it is low on liquid assets relative to liabilities, and it lost RM19m in the last year. So we're not very excited about owning this stock. Its too risky for us. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 3 warning signs for Ahmad Zaki Resources Berhad (2 are a bit unpleasant!) that you should be aware of before investing here.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:AZRB

Ahmad Zaki Resources Berhad

Ahmad Zaki Resources Berhad, and investment holding company, provides management services and acts as a contractor of civil and structural works in Malaysia, Indonesia, India, and the Kingdom of Saudi Arabia.

Fair value with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026