Here's Why We Think Ajiya Berhad (KLSE:AJIYA) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Ajiya Berhad (KLSE:AJIYA). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Ajiya Berhad with the means to add long-term value to shareholders.

See our latest analysis for Ajiya Berhad

Ajiya Berhad's Improving Profits

Even when EPS earnings per share (EPS) growth is unexceptional, company value can be created if this rate is sustained each year. So it's easy to see why many investors focus in on EPS growth. To the delight of shareholders, Ajiya Berhad's EPS soared from RM0.048 to RM0.073, over the last year. That's a commendable gain of 51%.

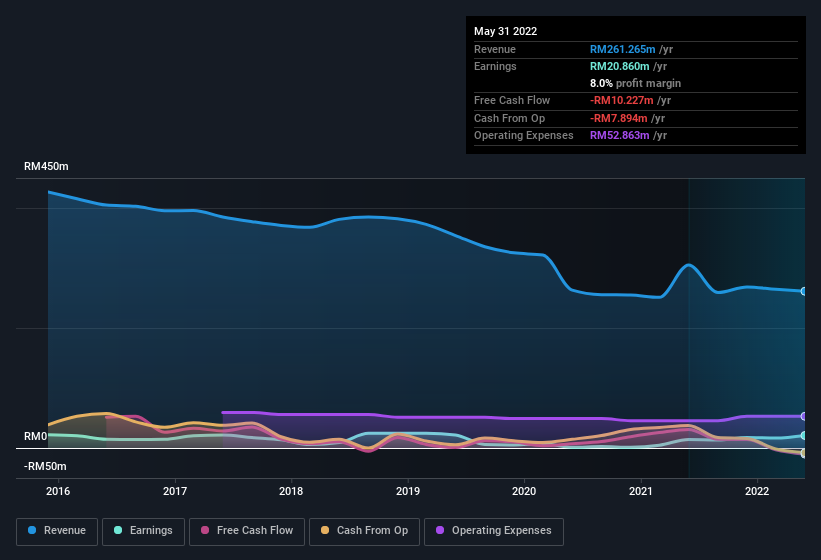

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Unfortunately, Ajiya Berhad's revenue dropped 14% last year, but the silver lining is that EBIT margins improved from 4.6% to 7.7%. While not disastrous, these figures could be better.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Ajiya Berhad isn't a huge company, given its market capitalisation of RM371m. That makes it extra important to check on its balance sheet strength.

Are Ajiya Berhad Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Shareholders will be pleased by the fact that insiders own Ajiya Berhad shares worth a considerable sum. As a matter of fact, their holding is valued at RM126m. That's a lot of money, and no small incentive to work hard. As a percentage, this totals to 34% of the shares on issue for the business, an appreciable amount considering the market cap.

Should You Add Ajiya Berhad To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Ajiya Berhad's strong EPS growth. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. Still, you should learn about the 3 warning signs we've spotted with Ajiya Berhad (including 1 which is a bit unpleasant).

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:AJIYA

Ajiya Berhad

An investment holding company, manufactures and trades in roofing materials and various glasses in Malaysia and Thailand.

Excellent balance sheet with proven track record.