Some AbleGroup Berhad (KLSE:ABLEGRP) Shareholders Have Copped A Big 52% Share Price Drop

This month, we saw the AbleGroup Berhad (KLSE:ABLEGRP) up an impressive 36%. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. In that time the share price has delivered a rude shock to holders, who find themselves down 52% after a long stretch. So we're hesitant to put much weight behind the short term increase. Of course, this could be the start of a turnaround.

Check out our latest analysis for AbleGroup Berhad

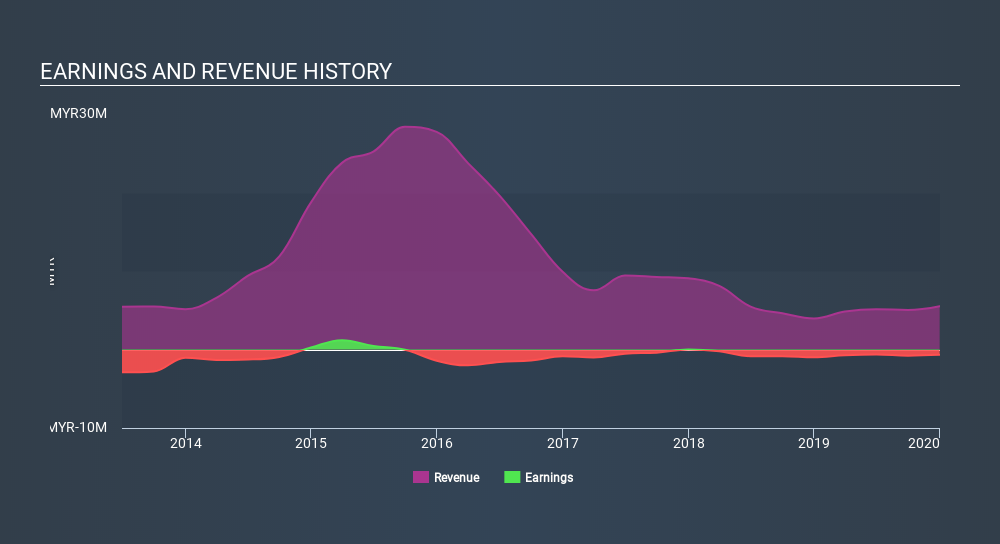

AbleGroup Berhad wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years AbleGroup Berhad saw its revenue shrink by 38% per year. That's definitely a weaker result than most pre-profit companies report. Arguably, the market has responded appropriately to this business performance by sending the share price down 14% (annualized) in the same time period. It's fair to say most investors don't like to invest in loss making companies with falling revenue. This looks like a really risky stock to buy, at a glance.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on AbleGroup Berhad's earnings, revenue and cash flow.

A Different Perspective

It's good to see that AbleGroup Berhad has rewarded shareholders with a total shareholder return of 7.1% in the last twelve months. That certainly beats the loss of about 14% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 4 warning signs for AbleGroup Berhad (2 are concerning) that you should be aware of.

Of course AbleGroup Berhad may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About KLSE:ABLEGRP

AbleGroup Berhad

An investment holding company, engages in the processing, trading, and contract workmanship of marble and granite slabs in Malaysia.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives