If You Like EPS Growth Then Check Out Hong Leong Financial Group Berhad (KLSE:HLFG) Before It's Too Late

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Hong Leong Financial Group Berhad (KLSE:HLFG), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Hong Leong Financial Group Berhad

Hong Leong Financial Group Berhad's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Hong Leong Financial Group Berhad managed to grow EPS by 9.3% per year, over three years. That's a pretty good rate, if the company can sustain it.

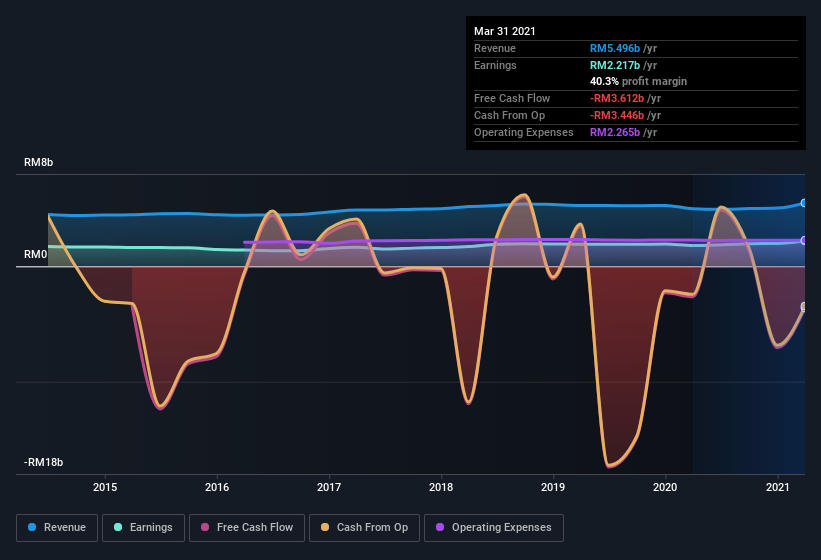

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). I note that Hong Leong Financial Group Berhad's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Hong Leong Financial Group Berhad maintained stable EBIT margins over the last year, all while growing revenue 10% to RM5.5b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Hong Leong Financial Group Berhad.

Are Hong Leong Financial Group Berhad Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Hong Leong Financial Group Berhad insiders have a significant amount of capital invested in the stock. With a whopping RM384m worth of shares as a group, insiders have plenty riding on the company's success. This should keep them focused on creating long term value for shareholders.

Does Hong Leong Financial Group Berhad Deserve A Spot On Your Watchlist?

One important encouraging feature of Hong Leong Financial Group Berhad is that it is growing profits. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. If you think Hong Leong Financial Group Berhad might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hong Leong Financial Group Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:HLFG

Hong Leong Financial Group Berhad

An investment holding company, provides investment banking, stockbroking, and fund management business of financial services to consumer, corporate, and institutional customers.

Very undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives