- Malaysia

- /

- Auto Components

- /

- KLSE:ESAFE

These 4 Measures Indicate That Eversafe Rubber Berhad (KLSE:ESAFE) Is Using Debt Safely

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Eversafe Rubber Berhad (KLSE:ESAFE) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Eversafe Rubber Berhad

How Much Debt Does Eversafe Rubber Berhad Carry?

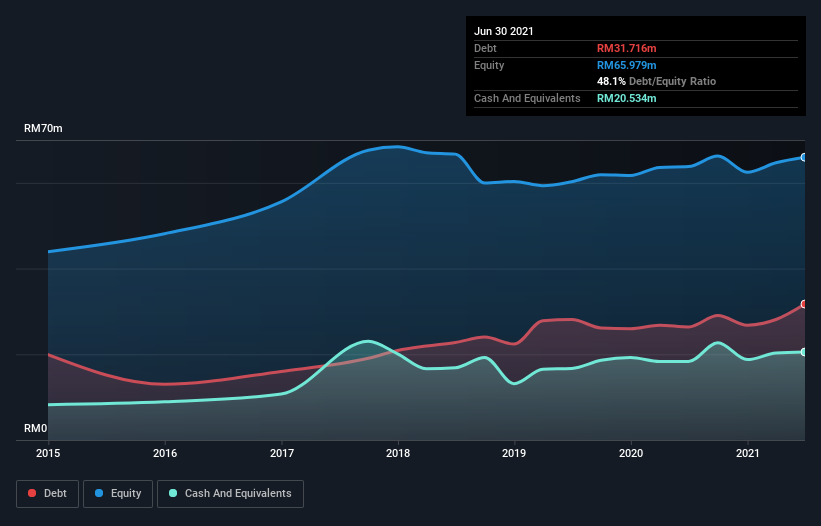

The image below, which you can click on for greater detail, shows that at June 2021 Eversafe Rubber Berhad had debt of RM31.7m, up from RM26.4m in one year. However, it also had RM20.5m in cash, and so its net debt is RM11.2m.

How Healthy Is Eversafe Rubber Berhad's Balance Sheet?

According to the last reported balance sheet, Eversafe Rubber Berhad had liabilities of RM40.1m due within 12 months, and liabilities of RM11.4m due beyond 12 months. Offsetting these obligations, it had cash of RM20.5m as well as receivables valued at RM28.1m due within 12 months. So its liabilities total RM2.98m more than the combination of its cash and short-term receivables.

Of course, Eversafe Rubber Berhad has a market capitalization of RM75.8m, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Eversafe Rubber Berhad has net debt of just 0.98 times EBITDA, indicating that it is certainly not a reckless borrower. And it boasts interest cover of 7.6 times, which is more than adequate. Another good sign is that Eversafe Rubber Berhad has been able to increase its EBIT by 28% in twelve months, making it easier to pay down debt. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Eversafe Rubber Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Eversafe Rubber Berhad generated free cash flow amounting to a very robust 85% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Our View

Eversafe Rubber Berhad's conversion of EBIT to free cash flow suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And that's just the beginning of the good news since its EBIT growth rate is also very heartening. Overall, we don't think Eversafe Rubber Berhad is taking any bad risks, as its debt load seems modest. So the balance sheet looks pretty healthy, to us. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 4 warning signs for Eversafe Rubber Berhad you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eversafe Rubber Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:ESAFE

Eversafe Rubber Berhad

An investment holding company, develops, manufactures, distributes, and sells tyre retreading materials to tyre retreaders and rubber material traders.

Good value with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026