- Malaysia

- /

- Auto Components

- /

- KLSE:ESAFE

These 4 Measures Indicate That Eversafe Rubber Berhad (KLSE:ESAFE) Is Using Debt Reasonably Well

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Eversafe Rubber Berhad (KLSE:ESAFE) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Eversafe Rubber Berhad

How Much Debt Does Eversafe Rubber Berhad Carry?

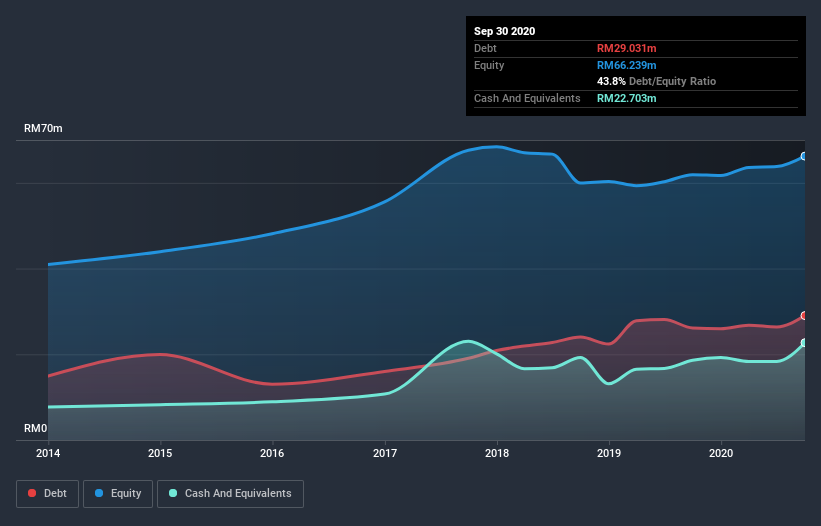

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Eversafe Rubber Berhad had RM29.0m of debt, an increase on RM26.1m, over one year. However, it does have RM22.7m in cash offsetting this, leading to net debt of about RM6.33m.

How Strong Is Eversafe Rubber Berhad's Balance Sheet?

According to the last reported balance sheet, Eversafe Rubber Berhad had liabilities of RM34.1m due within 12 months, and liabilities of RM11.5m due beyond 12 months. On the other hand, it had cash of RM22.7m and RM28.3m worth of receivables due within a year. So it can boast RM5.42m more liquid assets than total liabilities.

This short term liquidity is a sign that Eversafe Rubber Berhad could probably pay off its debt with ease, as its balance sheet is far from stretched.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Eversafe Rubber Berhad's low debt to EBITDA ratio of 0.51 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 4.4 times last year does give us pause. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. It is well worth noting that Eversafe Rubber Berhad's EBIT shot up like bamboo after rain, gaining 72% in the last twelve months. That'll make it easier to manage its debt. There's no doubt that we learn most about debt from the balance sheet. But it is Eversafe Rubber Berhad's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Eversafe Rubber Berhad recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

Eversafe Rubber Berhad's EBIT growth rate suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But we must concede we find its conversion of EBIT to free cash flow has the opposite effect. Looking at all the aforementioned factors together, it strikes us that Eversafe Rubber Berhad can handle its debt fairly comfortably. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Eversafe Rubber Berhad is showing 4 warning signs in our investment analysis , and 1 of those is significant...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade Eversafe Rubber Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eversafe Rubber Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:ESAFE

Eversafe Rubber Berhad

An investment holding company, develops, manufactures, distributes, and sells tyre retreading materials to tyre retreaders and rubber material traders.

Good value with slight risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026